U.S. Expat Tax Guide for U.S. Citizens Abroad Reporting for FBAR FATCA u0026 More - Golding u0026 Golding

https://www.goldinglawyers.com

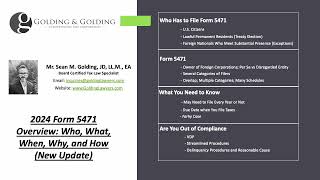

For expats who are considered to be U.S. persons for tax purposes, such as United States Citizens, Lawful Permanent Residents, and foreign nationals who meet the substantial presence test, they may have an annual tax and reporting requirement even though they live overseas — and even if all of their income is sourced from foreign sources. That is because the United States follows A worldwide income tax model, which means if a person qualifies as a US person for tax purposes, then they are subject to US tax on their worldwide income no matter where they live. This is different than most other countries which only require worldwide income tax for taxpayers who are considered residents of their country. Here is our new updated expat tax planning guide for US taxes to assist expats with understanding the basics of expat tax filing.