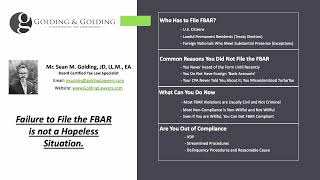

2024 Delinquency Procedures for FBAR Form 8938 5471 3520 (Golding u0026 Golding Board-Certified)

https://www.goldinglawyers.com

The Internal Revenue Service continues to move full steam ahead on enforcement matters involving noncompliance with FBAR reporting (Foreign Bank and Financial Account Reporting aka FinCEN Form 114). As the FBAR is not part of the 1040 tax return, many tax professionals are (understandably) unaware of the existence of the FBAR filing requirements when counseling their clients. As a result, it is not uncommon for a US Taxpayer to be several years out of compliance before realizing they missed the required FBAR and other international reporting form filing requirements. Despite all the fearmongering Taxpayers will undoubtedly find online, there are actually several safe options available for Taxpayers to safely get into compliance with the US Government for FBAR and other international information reporting forms. These offshore compliance programs vary based on the facts and circumstances of the Taxpayer and not all Taxpayers will qualify for every program. Let’s review the basics of the different delinquent FBAR latefiling submission procedures: