Tax Favored Foreign Retirement Trust Reporting and Exceptions Golding u0026 Golding (Board--Certified)

https://www.goldinglawyers.com

TaxFavored Foreign Retirement/NonRetirement Trusts

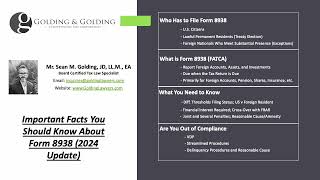

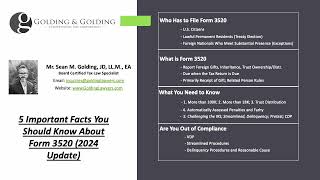

One of the biggest headaches for U.S. Taxpayers across the globe who have retirement accounts in foreign countries is having to report them accurately on their U.S. tax return. While reporting these 'accounts' on the FBAR and Form 8938 is usually manageable, Forms 3520 and 3520A can make the reporting much more complicated. The reason that this type of reporting is such a big headache, is because most of these retirement accounts are technically considered to be trusts. And, since foreign retirement accounts may be characterized as 'trusts' for U.S. tax and reporting purposes, it may necessitate the taxpayer having to file Form 3520 and Form 3520A to report the foreign retirement accounts to the IRS. Adding insult to injury is that these two forms were not designed to require foreign retirement accounts to have to be reported. Rather, Forms 3520/3520A were designed to avoid abusive tax schemes and other types of offshore trusts. Thus, many taxpayers who want to comply with the reporting rules and file these forms find it impossible to even obtain the information necessary to do so.

Recently, the IRS proposed certain regulations to help bring more guidance to taxpayers when it comes to having to report these taxfavored form retirement accounts. While there are already some rules in the book such as Revenue Procedure 201455 and Revenue Procedure 202017, under the regulation proposals, it would bring a little more clarity for taxpayers who are trying to be compliant.