Failure to File an FBAR is Not a Hopeless Situation. You Are NOT Stuck (Golding u0026 Golding 2024)

https://www.goldinglawyers.com

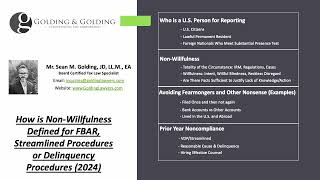

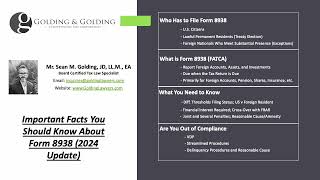

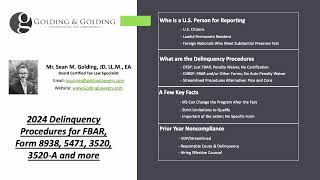

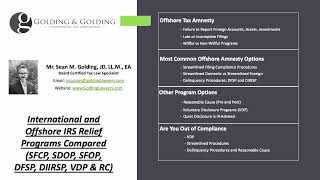

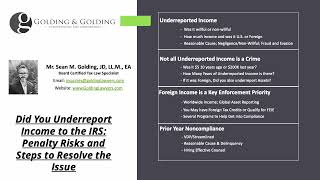

With the recent increase in enforcement by the Internal Revenue Service on matters involving foreign accounts, assets, and investments, many U.S. taxpayers who find themselves out of international information reporting compliance may feel especially overwhelmed or hopeless about what they can do to get into compliance. It is important to note, that while there is an extensive amount of fearmongering and scaremongering online, more often than not noncompliance with FBAR or FATCA can be resolved relatively simply by entering one of the offshore disclosure programs. There are different types of programs depending on whether the taxpayer is willful or nonwillful and whether or not they have undisclosed income or if they only fail to report certain forms. Let's take a look at the basics of what to do if you have unfiled FBARs for prior years.