It was never so easy to get YouTube subscribers

U.S. Taxation of Foreign Trusts for Owners and Beneficiaries - Golding u0026 Golding (Board-Certified)

https://www.goldinglawyers.com

Golding & Golding's Foreign Trust Reporting Overview

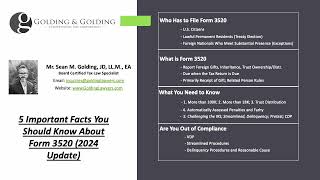

When it comes to international tax and reporting, foreign trust tax and reporting are two of the most complicated aspects of annual foreign investment compliance. This is because of many different reasons, such as:

What is a foreign trust?

When is a foreign trust taxable?

When is a foreign trust reportable?

Does the foreign trust qualify for any exceptions (Revenue Procedure 202017)

Is there a trustee reporting the trust on Form 3520/3520A

Were there any distributions?

Are there late forms that need to be filed?

Recommended

![How to Set Up a Trust Fund in 2023 [StepbyStep]](https://i.ytimg.com/vi/-OIVtJ10cnk/mqdefault.jpg)