You should NOT get an IUL if...

Book a Meeting http://leveragedcvli.com/3SR8ZFe

Want a Policy Reviewed? https://leveragedcvli.com/3PhIxCH

❓ Ask a Question http://leveragedcvli.com/48ooBoB

We talk to hundreds of people each year about life insurance, and many should NOT get an IUL. In this video Matt, Brady, and Aaron explore 3 common situations that an IUL is a BAD fit for.

Key Points:

Introduction to the topic: The video begins by addressing common misconceptions about Indexed Universal Life (IUL) insurance policies and the reasons some individuals may not be suitable candidates for such an investment.

Misconception of IUL as a Financial Savior: The first reason discussed is the mistaken belief that an IUL policy can solve all financial problems. It's emphasized that while IUL can be a valuable tool in a financial portfolio, it cannot rectify past financial mistakes or serve as a onesizefitsall solution to financial issues.

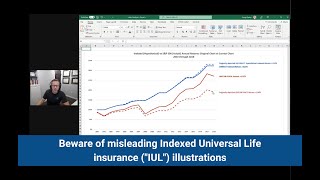

Incorrect Comparison with Other Investments: Another reason highlighted is the inappropriate comparison of IUL returns with those from direct stock market investments. It's clarified that IUL should be viewed as a diversification tool rather than a direct competitor to traditional investment portfolios, offering different benefits such as tax advantages and risk management.

Short Time Horizon for Policy Utilization: The discussion also covers how IUL policies are not suitable for individuals with shortterm financial goals, especially those looking to access their funds within a few years. IUL is designed for longterm growth and tax advantages, making it inefficient for shortterm liquidity needs.

Influence of Social Media Misinformation: The video touches on how social media platforms like TikTok and Instagram can spread misleading information about IUL policies, creating unrealistic expectations among potential buyers. It's stressed that professional advice should be sought to understand the true benefits and limitations of IUL.

Seeking Professional Guidance: The importance of consulting with financial professionals who can provide objective advice based on an individual's specific goals and financial situation is underscored. Viewers are encouraged to schedule a discovery call with the team to explore whether IUL fits their financial planning needs.

Conclusion and Call to Action: The video concludes with an invitation for viewers to engage in a personalized consultation to assess the suitability of IUL for their financial goals. Contact information and the process for booking a consultation are provided.

This summary encapsulates the key points discussed in the video, cautioning viewers against common misconceptions about IUL policies and emphasizing the importance of professional financial advice for personalized planning.

IUL for Real Estate?: • Should you invest in Real Estate with...