Session 25: Valuation - The Last Frontier!

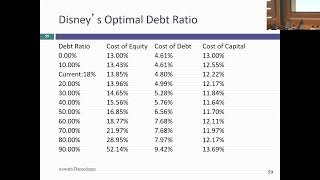

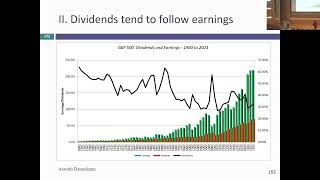

In thissession, we continued on the question of how best to value a company by first looking at the four key components of value cash flows from existing investments, growth in the future, discount rates and the terminal value. With cash flows, we noted the contrast between cash flows to equity and cash flows to the firm, with the former being after debt payments and the latter before. With discount rates, we argued that the same discount rates that we computed for investment hurdle rates can be used in valuation, with the caveat that these discount rates will change over time, as a company changes. While you can adjust betas, costs of debt and debt ratios, a simpler way to target a cost of capital in stable growth is to look at the median cost of capital for companies. These numbers are from January 2024 . With growth, the key is recognition that growth comes from what companies do in terms on how much they reinvest and how well, rather than from outside sources. Finally, for terminal value, I argued that the growth rate in perpetuity has to be less than or equal to the risk free rate. Since you will be valuing companies in different stages in the life cycle, I would like you to use the spreadsheet linked below:

http://www.stern.nyu.edu/~adamodar/pc...

As you can see, the valuation is built around revenue growth, operating margins and sales to capital ratios, all variables we spent time talking about in class.

Slides: https://pages.stern.nyu.edu/~adamodar...

Post class test: https://pages.stern.nyu.edu/~adamodar...

Post class test solution: https://pages.stern.nyu.edu/~adamodar...