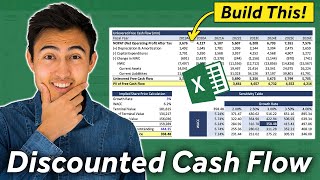

Discounted Cash Flow | DCF Model Step by Step Guide

Discounted Cash Flow step by step guide using free DCF excel model.

Get 25% OFF Financial Edge Using Code KENJI25: https://bit.ly/3Ds47vS'>https://bit.ly/3Ds47vS

RESOURCES:

DCF Template for this video: https://view.flodesk.com/pages/61fba6...

Valuation Methods Video: • How to Value a Company | Best Valuati...

In this video, we go over how to create a discounted cash flow with the end goal of reaching a company's intrinsic value. Through this, we can determine if a company's share price is over or undervalued. From free cash flows, to the WACC, to Terminal value, all the technical concepts are explained and applied using the Excel model.

Key steps in this DCF model:

Forecast the FCF, typically for a 510y period

Calculate the Weighted Average Cost of Capital (WACC)

Calculate the Terminal Value

Discount the cash flows to present

Reach a valuation and calculate an implied share price

LEARN:

The Complete Finance & Valuation Course: https://www.careerprinciples.com/cour...

Excel for Business & Finance Course: https://www.careerprinciples.com/cour...

Get 25% OFF Financial Edge Using Code KENJI25: https://bit.ly/3Ds47vS'>https://bit.ly/3Ds47vS

SOCIALS:

Instagram / kenji_explains

TikTok https://www.tiktok.com/@kenjiexplains...

GEAR:

My Gear: https://kit.co/kenjiexplains

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Chapters:

0:00 Intro

1:08 DCF Steps

2:40 Free Cash Flow

6:23 WACC

9:35 Terminal Value

12:11 Discounting Cash Flows

13:45 Equity Value

15:05 Full DCF Model

19:22 Assumptions

Disclaimer: I may receive a small commission on some of the links provided at no extra cost to you.