Session 26 (Val Undergrad): Distressed Equity as an Option and Acquirers' Anonymous

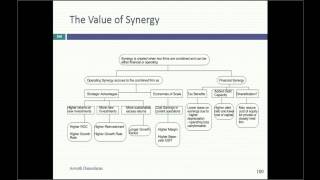

We started this session by looking at the value of flexibility through the option pricing lens and concluding that the value of flexibility is greatest at capital constrained firms, with uncertain and lucrative investment opportunities. We then turned to looking at distressed equity as an option, focusing on moneylosing companies with a lot of debt, and used that template to talk about why equity in deeply troubled firms can continue to trade in the face of financial adversity, how equity investors can shift risk at highly levered firms and why equity in conglomerates can become less valuable, even if you buy companies are fair value. I am sorry if you found the rest of today's session to be a downer. Don't get me wrong. Acquisitions are exciting and fun to be part of but they are not great value creators and in today's sessions, I tried to look at some of the reasons. While the mechanical reasons, using the wrong discount rate or valuing synergy & control right, are relatively easy to fix, the underlying problems of hubris, ego and over confidence are much more difficult to navigate.

Slides: https://pages.stern.nyu.edu/~adamodar...

Postclass test: https://www.stern.nyu.edu/~adamodar/p...

Postclass test solution: https://www.stern.nyu.edu/~adamodar/p...