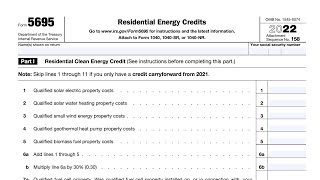

Residential Clean Energy Credit Limit Worksheet walkthrough (IRS Form 5695 Line 14)

Subscribe to our YouTube channel: / @teachmepersonalfinance2169

Use this worksheet to determine how much of the residential clean energy credit you can deduct in the current tax year, and how much you should carry forward to future tax years.

Learn more about the entire tax form by reading our guide: https://www.teachmepersonalfinance.co...

If you want to avoid calculation mistakes, download our Residential Clean Energy Credit Worksheet: https://tmepersonalfinance.etsy.com/l...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

Here are links to articles we've written about other tax forms mentioned in this video:

IRS Schedule 3, Additional Credits and Payments

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule 3 walkthrough (Additiona...

IRS Schedule 2, Additional Taxes

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule 2 walkthrough (Additiona...

IRS Form 6251, Alternative Minimum Tax

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 6251 walkthrough (Alternativ...

IRS Form 1116, Foreign Tax Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 1116 walkthrough (Foreign Ta...

IRS Form 8978, Partner’s Additional Reporting Year Tax

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8978 walkthrough (Partner’s ...

IRS Form 2441, Child and Dependent Care Expenses

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 2441 walkthrough ARCHIVED ...

IRS Schedule R, Tax Credit for the Elderly or Disabled

Article: https://www.teachmepersonalfinance.co...

Video: • Schedule R Walkthrough (Credit for th...

IRS Form 8863, Education Credits

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8863 walkthrough (Education ...

IRS Form 8880, Credit for Qualified Retirement Savings Contributions

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8880 walkthrough (Credit for...

IRS Form 8910, Qualified Alternative Vehicle Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8910 walkthrough (Alternativ...

IRS Form 8936, Qualified Plugin Electric Drive Motor Vehicle Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8936 walkthrough (Qualified ...

IRS Schedule 8812, Child Tax Credit or Credit for Other Dependents

Article: https://www.teachmepersonalfinance.co...

Video: • Schedule 8812 walkthrough (Credits fo...

IRS Form 8396, Mortgage Interest Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8396 walkthrough (Mortgage I...

IRS Form 8839, Qualified Adoption Expenses

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8839 walkthrough (Qualified ...

IRS Form 8859, Carryforward of the District of Columbia FirstTime Homebuyer Credit

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8859 walkthrough (Carryforwa...