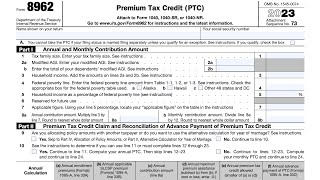

How to File Form 8962 for Premium Tax Credit. Step-by-Step Guide for 2023

Form 8962 is required with Form 1040 when a taxpayer has advanced premium tax credits paid as part of their enrollment in a qualified health plan through the insurance marketplace.

When taxpayers receive Form 1095A, they must use the information provided to reconcile their premium tax credit on Form 8962. The taxpayer may be entitled to an additional credit or have to repay some of that advanced credit.

For a 2022 Example: • How to File Form 8962 for 2022. Step...

For a 2021 Example: • IRS Form 8962 Premium Tax Credit and ...

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#Form8962 #Form1095A #HealthInsurance