IRS Schedule 2 Form 1040 - Line by Line Instructions for Additional Taxes

See the links below for more detailed tutorials on each line item.

Schedule 2 (Additional Taxes) is included with a Taxpayer's Form 1040 to report additional taxes other than the ordinary federal income taxes calculated and reported on Line 16, Page 2, Form 1040.

For more detailed videos on certain line items, see our links below:

Alternative Minimum Taxes (AMT Form 6251)

Form 6251 for Private Activity Bonds: • How to File IRS Form 6251 for AMT Adj...

Form 6251 for ISO Adjustments: • IRS Form 6251 Alternative Minimum Tax...

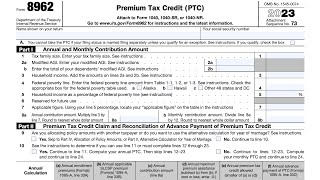

IRS Form 8962 (Premium Tax Credit)

2023 Form 8962: • How to File Form 8962 for Premium Tax...

2022 Form 8962: • How to File Form 8962 for 2022. Step...

2020 Form 8962: • IRS Form 8962 Premium Tax Credit and ...

Self Employment Taxes Schedule SE and Schedule C

TurboTax Schedule C Tutorial: • TurboTax 2022 Form 1040 Schedule C ...

TurboTax Schedule C Tutorial: • TurboTax 2022 Form 1040 Schedule C ...

Schedule C Tutorial: • StepbyStep Guide on How to Complete...

Form 4137 Unreported Tip Income: • IRS Form 4137 Social Security and M...

Schedule H Household Employment Tax: • Schedule H for Household Employee Tax...

Additional Medicare Taxes Form 8959

Form 8959 for 2023: • IRS Form 8959 Walkthrough for Additio...

Form 8959 for 2020: • How to Complete IRS Form 8959 Addit...

Net Investment Income Tax (NIT) Form 8960

Form 8960 for 2020: • How to Complete IRS Form 8960 Net I...

Health Savings Accounts (HSA) Form 8889

Form 8889 for 2020: • How to Complete IRS Form 8889 for Hea...

TurboTax Form 8889 Entry: • TurboTax 2022 Form 1040 How to Reco...

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#Form1040 #Schedule2 #FederalTaxes