IRS Schedule 1 Form 1040 - Line by Line Instructions u0026 Examples

See the links below for more detailed tutorials on each line item.

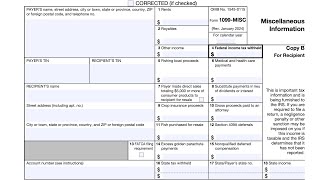

Schedule 1 (Additional Income & Adjustments) is filed with a Taxpayer's Form 1040 to report other items of income and deductions that are not reported directly on Page 1 of Form 1040.

In this video, we walk through some of the most common Schedule 1 income items, and we have links below to more detailed tutorials.

Schedule C (Profit and Loss from Business)

TurboTax Schedule C for Furniture Store: • TurboTax 2022 Form 1040 Schedule C ...

TurboTax Schedule C Tutorial: • TurboTax 2022 Form 1040 Schedule C ...

Schedule C Example: • StepbyStep Guide on How to Complete...

Form 4797 (Sale of Business Property)

Sale of Business Vehicles: • How to File IRS Form 4797 Sale of Bus...

Sale of Real Estate: • How to Complete IRS Form 4797 For the...

Nonrecaptured Section 1231 Losses: • How to File IRS Form 4797 Nonrecapt...

Section 1250 Recapture: • How to File IRS Form 4797 Section 1...

Stock Trader MTM Election: • How to Complete IRS Form 4797 for Sec...

Schedule E (Supplemental Income & Loss)

TurboTax Royalty Income: • TurboTax 2022 Form 1040 Schedule E ...

Record Unreimbursed Partnership Expenses: • How to Record your Unreimbursed Partn...

Gambling Income and Losses (Form W2G)

How to Report Gambling Winnings & Losses: • How to Report Gambling Winnings & Los...

Gambling Winnings & Losses Example: • Form 1040 Gambling Winnings and Losses

Form 5754 Split Winnings: • IRS Form 5754 How to Split Gambling...

Cancelled Debt Income (Form 1099C)

Form 982 Example for Excluded Debts: • IRS Form 1099C Explained with Form 9...

Form 1099C Cancelled Debt Exclusion: • Cancelled Debt Income is Taxable! Us...

S Corporation Debt Forgiveness: • S Corporation Debt Forgiveness Is i...

Form 1099K Reporting for Personal Sales

TurboTax Form 1099K Losses: • TurboTax 2022 Form 1040 Enter Form ...

TurboTax Form 1099K Gains: • TurboTax 2022 Form 1040 Enter Form ...

Tax Issues on Personal 1099K Reporting: • U.S. Taxes on Sale of Personal Use It...

How to Report Personal Use Sale: • How to Report Form 1099K on Form 104...

Form 1099K $600 Rules: • $600 Rule for 2022. Form 1099K from...

IRS Suspends 1099K Reporting: • IRS Suspends $600 Form 1099K Reporti...

Form 8889 Health Savings Accounts (HSA)

TurboTax Form 8889 Tutorial: • TurboTax 2022 Form 1040 How to Reco...

How to Form 8889 Tutorial: • How to Complete IRS Form 8889 for Hea...

SelfEmployment Taxes (Schedule SE)

Taxes on Partnership Income: • Do I Pay SelfEmployment Taxes on Par...

SelfEmployed Health Insurance Deduction (Form 7206)

IRS Form 7206 Tutorial: • IRS Form 7206 for SelfEmployed Healt...

Health Insurance S Corp Shareholder: • How to Deduct Health Insurance for S ...

Penalty on Early Withdrawal of Savings Accounts

Early Withdrawal on CD: • IRS Form 1099INT: Early Withdrawal ...

Traditional IRA Contribution Deduction

TurboTax Traditional IRA Contribution: • TurboTax 2022 Form 1040 Traditional...

Backdoor Roth IRA: • What is the Backdoor Roth IRA Convers...

Max IRA Contribution for 2021 & 2022: • Maximum Traditional IRA Contribution ...

Form 8606 Nondeductible Contribution: • StepbyStep Guide to IRS Form 8606 ...

Student Loan Interest Deduction

How to Record Form 1098E: • How to Deduct Student Loan Interest o...

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#Form1040 #Schedule1 #TaxReturn