Data Update 7 for 2023: Dividends Buybacks and Cashflows

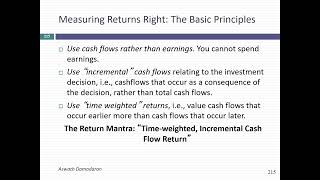

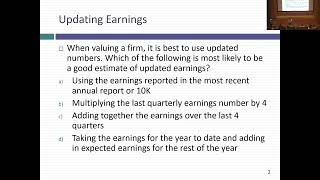

Dividends are residual cash flows, and in a wellfunctioning business should represent the last step in a sequence that starts with investing choices, with financing choices occurring concurrently and ending with dividends. In practice, though, there are companies that allow dividend policy to climb to the top of the sequence skewing investing and financing decisions. In this post, I provide a process for estimating potential dividends, and talk about how those potential dividends change over the life cycle. I then look at how buybacks have surged as the preferred option for many companies, and not just in the US, and argue that it is the flexibility of buybacks (being able to drastically change already announced buybacks) that makes them so attractive to businesses, concerned about earnings predictability. I end with a discussion of the fictions around buybacks that they can add or destroy value (they cannot... they redistributed value), that they are being funded with debt (firms that buyback stocks have far lighter debt loads than first that do not), that they are bad for the economy (not true, since the buyback cash finds it way back into other companies that reinvest it) and that it is unfair to other stakeholders. Buffett's description of buyback critics as economic illiterates might be too kind, since much of the criticism comes from a mixture of ignorance and idealogical zeal.

Slides: https://pages.stern.nyu.edu/~adamodar...

Blog Post: https://aswathdamodaran.blogspot.com/...