What Self-Employed People Need to Know About Filing Bankruptcy

Determining income for people who get a regular paycheck is usually very easy. Pay stubs or bank statements clearly show what the debtor earned. But selfemployed filers face some complexities, both in proving income, and protecting the value of their business.

The Means Test and Income

People filing for Chapter 7 bankruptcy have to show that they pass what is known as the means test. The means test sets a maximum amount that someone can earn in order to be allowed to file for bankruptcy. If you earn less than the median amount in your state, you can file, and if you earn more, you will have to itemize certain deductions to see if you can file for Chapter 7.

But what does someone who is self employed actually make or earn? Often, showing this can be difficult, especially for smaller businesses where income, losses, profits and expenses can be commingled between business and personal or be irregular and sporadic.

Documenting Income

To document income to a bankruptcy trustee, you will have to prove a profit loss statement if you are selfemployed. Remember that although a lot of profit may be good for your business for a multitude of reasons, when it comes to bankruptcy, the court will often consider profit to be the amount that you made or took home in salary. If this isn’t the case, you need to work with your accountant to more accurately classify expenses and earnings on your statement.

You will also have to provide bank records not just for yourself (which you would have to do whether or not you own a business), but you will have to prove records for the business. This can include check stubs, bank statements, or copies of checks.

Average Income

Many people who are selfemployed don’t pay themselves the same thing all the time. They may make a large payout this month, a small one next month, a small distribution 2 weeks later, etc. In bankruptcy, your income is determined by the average that you made 6 months before filing. That means that if you can help it, you should try not to make large distributions that aren’t representative of your normal income, before the bankruptcy.

You want your previous 6 months’ average to be as close as possible to a realistic picture of what you normally earn, and not skewed upwards or downwards by any onetime events.

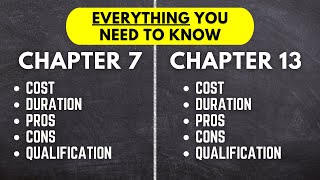

Chapter 7 vs. Chapter 13 for Sole Proprietors

If you are a sole proprietor, your business and personal debts are likely intertwined. Therefore, filing for bankruptcy means you need to list both personal and business income and debts.

If you qualify for Chapter 7 bankruptcy, your discharge could remove both personal and businessrelated debts. Chapter 7 could also be a good choice if you don’t have a lot of nonexempt assets to sell because you won’t lose too much of your property. Conversely, having several nonexempt assets means you may lose many of them since your trustee will need to sell them to pay some of your debt.

Chapter 13 bankruptcy can be a good option if you don’t qualify for Chapter 7 because it likely won’t cause much disruption in your business. Because you don’t have to sell any assets that could be vital to your business, you will be able to make monthly payments while you continue to operate.

But it’s important to ensure you have enough money to make your payments and still cover business expenses. Falling behind on your Chapter 13 payment plan puts you in danger of having your bankruptcy dismissed, leaving you back in the financial hardship you previously experienced.

Business vs. Personal Assets

Filing bankruptcy could mean liquidating some assets to help pay your debts, but your personal and business assets may be one and the same. For example, this would include personally owning tools or a vehicle and using them for work.

![How to File Bankruptcy Online without a Lawyer [and SAVE]](https://i.ytimg.com/vi/PvKuicgRLzM/mqdefault.jpg)