Schedule D Filing and Form 8949 - TaxSlayer Pro Income Tax Preparation Course (Module 5 Part 3)

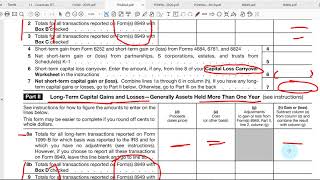

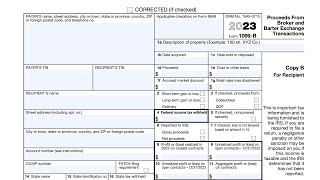

In Module Five, Part Three of our Income Tax Preparation Course, we'll be going over the Schedule D and Form 8949 Capital Gains and Losses. The most common taxable assets will be securities such as stocks or bonds, real estate, and valuable collectibles. Learn how to report capital gains and losses on tax returns for your clients by watching this video.

Our tax prep software for professional preparers is easy to use and helps you file your clients' taxes quickly. Set yourself up for success this tax season by using one of our tax software products. Learn more about each one here: https://www.taxslayerpro.com/compare...

Want to practice some tax returns? Try some here: https://www.taxslayerpro.com/educatio...

Stay up to date on the latest tax information by checking out our blog: https://www.taxslayerpro.com/blog/ or following any of our social media platforms:

Facebook: / taxslayerpro

LinkedIn: / taxslayerpro