Option Pricing Models Explained [With Formulas]

Subscribe to our channel to learn more about options trading strategies: bit.ly/2RmCiSg.

Visit http://www.OptionsEducation.org for more free online courses, podcasts, videos and webinars taught by options experts.

Contact our Investor Services team for help on your options questions and continued education at [email protected].

Options pricing models can help investors understand what an option is truly worth. There are several pricing models investors use to understand how stock price, volatility, and other inputs will affect the output of an investment. In this video presentation, get an introduction to frequently used pricing models and Greek risk metrics to help you evaluate your options investment plan.

To learn more about option pricing models and for interactive assignments, register for MyPath online. Study at your own pace and based on your own skill level : https://www.optionseducation.org/theo...

Options Pricing Model Video Checkpoints:

(6:40) Options pricing models: who makes the price and what are they worth?

(10:21) Options pricing inputs and outputs

(11:11) The BlackScholes Pricing Model

(12:00) OIC options calculator

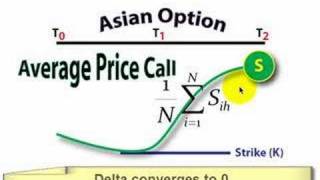

(13:42) CoxRossRubenstein Model

(14:06) What are the five Greeks?

(20:38) Option Delta definition and characteristics

(32:00) Option Gamma characteristics, impact, and expiration

(36:00) Option Theta calculations, expiration, and time decay

(45:15) Option Vega characteristics

(47:26) Historical vs implied volatility

(49:01) Option Rho characteristics

(50:11) Things to know about options pricing models

For daily options insight and more great content, follow us on our social media channels:

Twitter: @Options_Edu.

LinkedIn: / theoptionsin dustrycounciloic/

Facebook: / optionsindustrycouncil "