IV Rank vs. IV Percentile: Which is Better? | Measuring Implied Volatility

➥ Hypergrowth Options Strategy Course: https://geni.us/optionscourse

IV rank and IV percentile can both be used to gauge a stock's current level of implied volatility relative to its historical levels of implied volatility.

Gauging a stock's implied volatility is not straightforward, especially when comparing the implied volatility of two stocks. For example, one stock's 30% implied volatility could be high, while another stock's 70% implied volatility could be low. How can we tell the difference?

The answer is to use IV rank or IV percentile.

In this video, you'll learn:

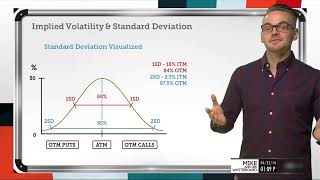

1. What IV rank and IV percentile represent.

2. How to calculate IV rank and IV percentile.

3. Why IV percentile serves as a better volatility reversion indicator.

==== FAVORITE OPTIONS TRADING BOOKS ====

How to Price & Trade Options: https://amzn.to/2FqsPmn

Option Volatility and Pricing: https://amzn.to/2SU6f8K tastytrade, Inc. (“tastytrade”) has entered into a Marketing Agreement with Project Finance(Marketing Agent”) whereby tastytrade pays compensation to Marketing Agent to recommend tastytrade’ brokerage services. The existence of this Marketing Agreement should not be deemed as an endorsement or recommendation of Marketing Agent by tastytrade and/or any of its affiliated companies. Neither tastytrade nor any of its affiliated companies is responsible for the privacy practices of Marketing Agent or this website. tastytrade does not warrant the accuracy or content of the products or services offered by Marketing Agent or this website. Marketing Agent is independent and is not an affiliate of tastytrade.

![Implied Volatility Trading Guide [2023]: EVERYTHING to Know Before Trading](https://i.ytimg.com/vi/s8jGRr1DuK4/mqdefault.jpg)