IRS Form 8889 walkthrough (Health Savings Accounts)

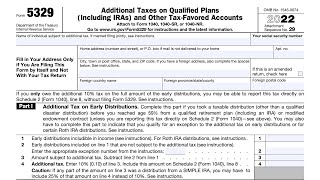

Purpose of Form

Use Form 8889 to:

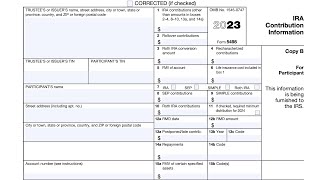

• Report health savings account (HSA) contributions (including those made on your behalf and employer contributions),

• Figure your HSA deduction,

• Report distributions from HSAs, and

• Figure amounts you must include in income and additional tax you may owe if you fail to be an eligible individual. Additional information.

See Pub. 969, Health Savings Accounts and Other TaxFavored Health Plans, for more details on HSAs. Also, see the Instructions for Form 1040 and the Instructions for Form 1040NR.

Who Must File

You must file Form 8889 if any of the

following applies.

• You (or someone on your behalf, including your employer) made contributions for 2022 to your HSA.

• You received HSA distributions in 2022.

• You must include certain amounts in income because you failed to be an

eligible individual during the testing period.

• You acquired an interest in an HSA because of the death of the account

beneficiary.

If you (or your spouse, if filing jointly) received HSA distributions in 2022, you must file Form 8889 with Form 1040, Form 1040SR, or Form 1040NR, even if you have no taxable income or any other reason for filing Form 1040, Form 1040SR, or Form 1040NR.

![NEW HSA Deduction: PAY LESS TAXES, Writeoff Health Expenses, and TAXFREE Wealth! [HSA Explained]](https://i.ytimg.com/vi/ufkIUC_raR8/mqdefault.jpg)