Ignore the Mega-Bubble Mania and Prioritize Shareholder Yield

Cambria Investment Management's Meb Faber joins the show to talk about the exchange

traded funds ("ETFs") at Cambria and why the team focuses on shareholder yield when

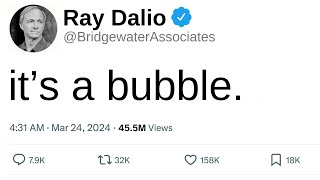

picking stocks for these ETFs. He breaks down the importance of shareholder yield in mega

bubble markets like today's and urges investors to pay more attention to it.

Meb then discusses managing risk on a portfolio level, including focusing on quality and

value. He also covers why emerging and foreign markets are so attractive today, the

opportunity in fixedincome investments like bonds and Treasury bills, and how higher

interest rates have changed the game.

Finally, Meb describes himself as a value investor and shares which areas of the economy

he's most concerned about. He talks about inflation driving commodities sharply higher, gold

hitting new highs, and why investing at alltime highs can still be a smart choice.

1:20 Meb Faber Talks Shareholder Yield

15:11 Managing Risk, Emerging Markets, Bonds

33:52 Inflation Concerns and Gold's New Highs