How To Report Crypto On Form 8949 For Taxes | CoinLedger

Sold or traded crypto? Learn how to easily report your crypto transactions to the IRS on Form 8949.

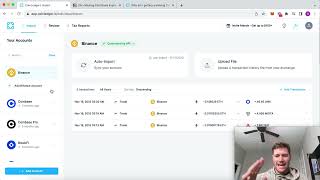

Form 8949 is required when filing your taxes for all US taxpayers who sold or disposed of their crypto during the year. In this video, Miles Brooks, CPA and crypto tax expert at CoinLedger explains what Form 8949 is and how to easily fill it out when filing your taxes.

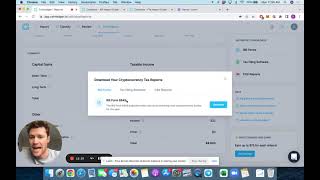

✅ Get started with CoinLedger, the crypto tax platform trusted by more than 300,000+ crypto and NFT investors. Generate a free preview report today: https://bit.ly/3LtPfB4

Learn more about Form 8949 and how to report crypto on your taxes: https://coinledger.io/blog/howtorep...

Learn more about CoinLedger: coinledger.io

Subscribe for more tax tips: / @coinledger

Connect with us on social media:

Miles’ Twitter: / milesbrookstax

CoinLedger Twitter: / coinledger

✅ Recommended Videos:

Crypto Taxes 101: StepByStep Guide: • Crypto Taxes 101: The Complete Stepb...

Crypto Cost Basis: Explained: • Cryptocurrency Cost Basis Explained f...

Timestamps:

0:00 Introduction

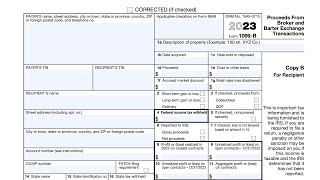

0:39 What is Form 8949?

1:10 How to fill out Form 8949

2:02 Example: How to report your crypto transactions

3:42 The easiest way to file Form 8949

#CryptoTaxes #cryptocurrency #Form8949