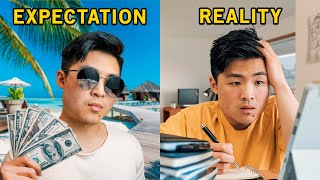

How To Invest In 2024 (Easy Beginners Guide)

Check out TD’s services and tools for saving and investing! https://www.td.com/ca/en/personalban...

WHERE TO INVEST

Mutual Funds (Canada): https://www.td.com/ca/en/personalban...

GICs (Canada): https://www.td.com/ca/en/personalban... cts/gic/)

ETFs/Stocks (Canada): https://www.td.com/ca/en/investing

For US residents: https://www.td.com/us/en/personalban...

NEWSLETTER

✉ Subscribe to my newsletter: https://mailchi.mp/ebf549d1a514/jense...

CONSULTING

I offer 1on1 consulting calls on business, entrepreneurship, social media, content creation, or life advice for a fee. Book here: https://calendly.com/jensentung/consu...

FILMMAKING

All My Video Gear + Equipment: https://kit.co/JensenTung

Where I Get My Music: https://fm.pxf.io/c/2922613/1347628/1...

How I Take Notes & Manage Projects: https://affiliate.notion.so/s7g8vhkbmnjf

STARRING

Jensen Tung: / jensentung

SOCIALS

YouTube: https://www.youtube.com/subscription_...

Instagram: / jensentung

⚪ TikTok: / jensentung

Facebook: / jensentungofficial

Twitch: / jensentung

⚫ Website: https://jensentung.com

I'm Jensen Tung, a filmmaker and entrepreneur with a love for entrepreneurship, personal finance, and selfimprovement. My goal is to help you create a more fulfilling life for yourself. Subscribe to be a part of the journey!

TIMESTAMPS

0:00 How To Invest

0:21 Definition

0:28 Step 1: Calculate how much money you gave

1:14 Step 2: Set up an Emergency Fund

1:51 Step 3: Create a strategy

3:11 Step 4: Pick your investments

3:25 Stocks

3:50 ETFs

4:24 Mutual Funds

4:49 GICs

6:02 Step 5: Open an investment account

6:18 TaxAdvantaged Account

7:05 Step 6: Purchase your investments

7:50 Dollar Cost Averaging (DCA)

8:25 How I'm investing in 2022

The video is about how to invest for beginners in 9 min. The video is clear and concise, and covers the basics of investing in an easytounderstand way. You'll learn about all the essential steps, like creating a budget, building an emergency fund, creating a strategy, different types of investments, taxadvantaged accounts, and purchasing your investments. I also talk about when to buy and Dollar Cost Averaging. By the end of this video, you'll be ready to start investing and be on your way to financial success!

DISCLAIMER

The information contained herein is for information purposes only. The information has been drawn from sources believed to be reliable.

The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual’s objectives and risk tolerance.

{NTD Mutual Fund Disclaimer}

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the fund facts and prospectus, which contain detailed investment information, before investing.

Mutual fund accounts are not covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer and are not guaranteed or insured. Their values change frequently. There can be no assurances that a money market fund will be able to maintain its net asset value per unit at a constant amount or that the full amount of your investment will be returned to you. Past performance may not be repeated. Mutual fund strategies and current holdings are subject to change.

Mutual Fund Representatives with TD Investment Services Inc. distribute mutual funds at TD Canada Trust. TD Mutual Funds and the TD Managed Assets Program portfolios are managed by TD Asset Management Inc., a whollyowned subsidiary of The TorontoDominion Bank and are available through authorized dealers.

® The TD logo and other trademarks are the property of The TorontoDominion Bank or its subsidiaries.

TFSA

Annual contribution limit for 2021 is $6,000. Annual contribution limit for 2019 and 2020 was $6,000 and from 2016 to 2018 was $5,500. Annual contribution limit for 2015 was $10,000. Annual contribution limit from 2013 to 2014 was $5,500. Annual contribution limit from 2009 to 2012 was $5,000. Annual TFSA contribution limit subject to change by the federal government.

RRSP

Subject to conditions and eligibility. Subject to conditions on the type of RRSP.

The RRSP contribution limit for the 2021 tax year is $27,830, or 18% of the earned income reported on your 2020 tax return — whichever is less. Any unused contribution room from previous years is also carried forward, so it could be more. Pension adjustments may also impact the contribution limit. You’ll find your current RRSP contribution limit in your latest Notice of Assessment or by contacting the Canada Revenue Agency (CRA).

![How To Use Canva For BEGINNERS! [FULL Canva Tutorial 2023]](https://i.ytimg.com/vi/un50Bs4BvZ8/mqdefault.jpg)