How Does a Qualified Intermediary Facilitate a 1031 Exchange?

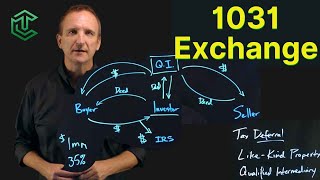

What is a QI (Qualified Intermediary), and how do they facilitate an IRC section 1031 exchange? Do you even need one? Well, a successful 1031 exchange isn't a doityourself project. You must follow IRS rules to realize the tax deferral benefits, and you'll need a middle person, called a qualified intermediary (QI). A QI is an unrelated party who participates in the taxdeferred, likekind exchange to facilitate the disposition of the Exchangor’s relinquished property and the acquisition of the Exchangor’s replacement property per the exchange agreement.

The Qualified Intermediary has NO economic interest except for any compensation (exchange fee) it may receive for facilitating the exchange as defined in Section 1031 of the Internal Revenue Code. A "Qualified Intermediary" is the correct technical reference according to Treasury Regulations, but the Qualified Intermediary can also known as the Accommodator, Facilitator or Intermediary while working in exchange services.

Tune in above as David Moore of Equity Advantage, 1031exchange.com walks us through the steps of facilitating a 1031 Tax Deferred Exchange in this months 1031 Exchange Blogcast!

OUR WEBSITE

http://www.1031exchange.com

http://www.iraadvantage.net

1031 EXCHANGE FAQ

http://www.1031exchange.com/faq/

SOCIAL MEDIA

Linkedin: / 484108

Facebook: / equityadvantage

Twitter: / barterbro

Instagram: / equity_advantage

Youtube: / @1031exchangeexperts

VISIT MY BLOG

https://www.1031exchange.com/category...

Disclaimer: All my opinions are my own. These statements are not meant to be taken as investment advice.