Fixed-Income Markets: Issuance Trading and Funding (2023 Level I CFA® Exam – Fixed Income–Module 2)

Prep Packages for the CFA® Program offered by AnalystPrep (study notes, video lessons, question bank, mock exams, and much more):

Level I: https://analystprep.com/shop/cfaleve...

Level II: https://analystprep.com/shop/learnpr...

Levels I, II & III (Lifetime access): https://analystprep.com/shop/cfaunli...

Prep Packages for the FRM® Program:

FRM Part I & Part II (Lifetime access): https://analystprep.com/shop/unlimite...

Topic 6 – Fixed Income Markets

Module 2 – FixedIncome Markets: Issuance, Trading and Funding

0:00 Introduction and Learning Outcome Statements

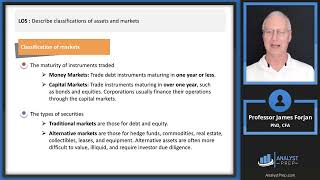

3:17 LOS : Describe classifications of global fixedincome markets.

5:50 LOS : Describe the use of interbank offered rates as reference rates in floatingrate debt.

9:13 LOS : Describe mechanisms available for issuing bonds in primary markets.

15:11 LOS : Describe secondary markets for bonds.

18:56 LOS : Describe securities issued by sovereign governments.

20:54 LOS : Describe securities issued by nonsovereign governments, quasigovernment entities, and supranational agencies.

24:46 LOS : Describe types of debt issued by corporations.

30:12 LOS : Describe structured financial instruments.

38:57 LOS : Describe shortterm funding alternatives available to banks.

39:39 LOS : Describe repurchase agreements and the risks associated with them.