Fixed income: Carry roll down (FRM T4-31)

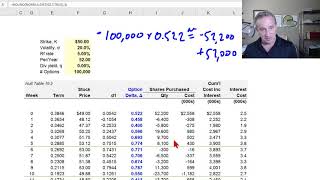

Financial Risk Manager (FRM, Topic 4: Valuation and Risk Models, Fixed Income, Bruce Tuckman Chapter 3, Returns, Spreads and Yields). The CarryRollDown is the price change in the bond due exclusively to the passage of time. It is only one component of a bond's total profit and loss (P&L). The bond's total P&L equals Price Appreciation plus Cash Carry (i.e., coupon). Price Appreciation equals CarryRollDown plus Price Change due to Shift in Rates (market risk) plus Price Change due to spread narrowing/widening (credit risk). Discuss this video here in our FRM forum: https://trtl.bz/2WkA3AA

Subscribe for future tutorials on expert finance and data science https://www.youtube.com/c/bionicturtl...

Our email contact is [email protected] (I can also be reached at [email protected])

For other videos in our Financial Risk Manager (FRM) series, see one of the following playlists:

Texas Instruments BA II+ Calculator

• Texas Instruments BA II+ Calculator

Risk Foundations (FRM Topic 1)

• Risk Foundations (FRM Topic 1)

Quantitative Analysis (FRM Topic 2)

• Quantitative Analysis (FRM Topic 2)

Financial Markets and Products: Intro to Derivatives (FRM Topic 3, Hull Ch 17)

• Financial Markets and Products: Intro...

Financial Markets and Products: Option Trading Strategies (FRM Topic 3, Hull Ch 1012)

• Financial Markets and Products: Optio...

FM&P: Intro to Derivatives: Exotic options (FRM Topic 3)

• FM&P: Intro to Derivatives: Exotic op...

Valuation and RIsk Models (FRM Topic 4)

• Valuation and RIsk Models (FRM Topic 4)

#bionicturtle #risk #financialriskmanager #FRM #finance #expertfinance