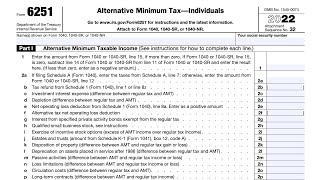

Do you need to complete IRS Form 6251 to calculate AMT (alternative minimum tax)?

Subscribe to our YouTube channel: / @teachmepersonalfinance2169

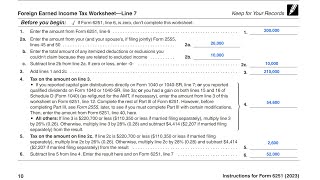

This worksheet, located in the instructions for Schedule 2, helps taxpayers determine whether or not they need to complete IRS Form 6251 to calculate any AMT liability.

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

Here are links to articles and videos we've created about other tax forms and schedules mentioned in this video:

IRS Schedule A, Itemized Deductions

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule A walkthrough (Itemized ...

IRS Form 6251, Alternative Minimum Tax

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 6251 walkthrough (Alternativ...

IRS Form 8995, Qualified Business Income Deduction Simplified Computation

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 8995 walkthrough (QBI Deduct...

IRS Form 8995A, Qualified Business Income Deduction

Article: https://www.teachmepersonalfinance.co...

IRS Schedule 1, Additional Income and Adjustments to Income

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule 1 walkthrough (Additiona...

IRS Schedule 2, Additional Taxes

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Schedule 2 walkthrough (Additiona...

IRS Form 4972, Tax on Lump Sum Distributions

Article: https://www.teachmepersonalfinance.co...

Video: • IRS Form 4972 walkthrough (Tax on Lum...