BEPS Pillar Two GloBE Rules - Overview

The twopillar corporate tax reform plan forms part of the OECD's project tackling base erosion and profit shifting (BEPS). Whilst Pillar One – which aims to align taxing rights more closely with the location of customers – will only apply initially to MNEs with annual global turnover above €20bn, Pillar Two is expected to have a wider impact on businesses.

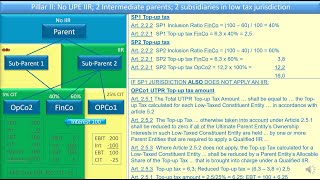

Pillar Two seeks to establish a global minimum corporate tax rate through a set of interlinked rules. Global antibase erosion rules (GloBE rules) will impose topup taxes where the effective rate of tax of a MNE in a jurisdiction is below the global minimum corporate tax rate (15%). There will also be a subject to tax rule (STTR) which will allow source taxation (for example, withholding taxes) on certain crossborder related party payments that are subject to tax below a minimum rate (9%).

For more information on the GloBE rules, please visit our website: https://www.traverssmith.com/knowledg...