A Balance Sheet Example

http://www.accounting101.org/balance...

The balance sheet is easy to understand... once you understand why what goes where. The balance sheet example on this page, as well as the video, will help explain what the balance sheet is, how it's organized, and how to interpret the information on it. The balance sheet is an extremely useful tool for all users to quickly get an idea of how a company is doing.

The balance sheet is usually described as a snapshot of a company's financial position. This is because the balance sheet is accounting for a single moment in time; not over a period such as the income statement. You'll notice in the example below, that the date is December 31, 2011. It basically means, "this is what we have, and this is who owns it as of today, December 31st, 2011." In contrast, the income statement would show a time period, such as "for the period ending December 31, 2011."

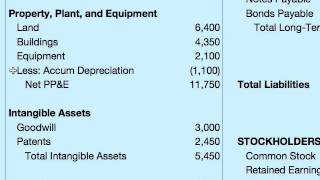

As you can see in the example above, there are three major parts or sections that make up the balance sheet. These are:

Assets

Liabilities

Owners' Equity

Assets are the things the company owns. These are things such as cash, accounts receivable, inventory, prepaid insurance, prepaid rent, and goodwill. There are basically two classifications of assets; current assets and fixed (or longterm) assets. Current assets are assets that will be used within one year. Current assets include cash, accounts receivable, inventory, prepaid insurance, and prepaid rent. There are other types of current assets, but those are the most common. Fixed assets are assets that will be around for longer than one year. Fixed assets include buildings, equipment, goodwill, and land. Asset accounts have a debit balance.

Liabilities are the obligations that a company has to repay. A liability could be amounts owed to a creditor, or to a vendor for supplies and inventory. Some examples of liability titles that you'll see are notes payable, accounts payable, wages payable, interest payable, income taxes payable, bonds payable, and unearned revenue. An easy way to spot a liability is anything that has the word "payable" in it. This obviously means an amount that still has to be paid, and will always represent a liability. Another type of liability is when a company receives payment for a product or service that they haven't delivered yet. This is called unearned revenue. Like assets, liabilities are also classified into both current and longterm liabilities. The same rules apply: a current liability is an obligation that has to be repaid within one year, and a longterm liability is an obligation doesn't need to be repaid within a year. Liability accounts have a credit balance.

Owners' equity, or stockholders' equity is basically the portion of the assets that the owners of company own. Since assets=liabilities+owners' equity, the assets of the company are either owned by someone external such as a creditor, or they are owned by the owners of the company, usually in the form of stockholders. The account titles in the owners' equity portion of the balance sheet are usually common stock, preferred stock, paidin capital in excess of par, and retained earnings. Owners' equity accounts have a credit balance.