5 Things To Know BEFORE Starting Your Commercial Banking Career

Click The Link Below For The ULTIMATE Commercial Banking Interview Prep Guide With Credit Case Studies

https://www.financekid.ca/products/co...

What should you know before starting your career in commercial banking? What are 5 things I wish I knew before applying for a commercial banking job? What are the different commercial banking divisions? What is the difference between credit risk management and financial restructuring? What is the difference between a credit analyst and relationship manager? How do different entry level commercial banking jobs differ based on compensation, client exposure, exit opportunities and more?

In today's video we answer the above questions and discuss the common things that students forget or don't know when applying for commercial banking roles. See below, did you know them all?

[3:13] #1: Travel Requirements

[6:31] #2: Understanding the different commercial banking divisions

[10:31] #2: Understanding the different entry level roles in commercial banking

[16:10] #2: Comparing commercial banking entry level roles for compensation vs working hours vs client exposure vs exit opportunities

[17:35] #3: What Matters Most When Choosing Your First Commercial Banking Job?

[21:07] #4: Do you need a CFA or CPA designation for commercial banking?

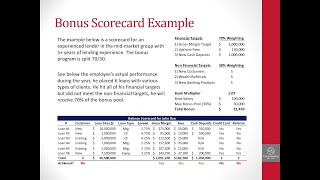

[24:55] #5: Expect a credit test or technical test during the interview process

If you have any other questions, please comment below. If you enjoyed the video and found it helpful, please like and subscribe to FinanceKid for more videos soon!

If you want to reach out via email, you can contact me at;

[email protected]

If you are looking to sell your business and would like to learn more about Roblee Capital, please reach out to me for an introductory call. You can contact me through email or through my LinkedIn at;

/ robertbezede20ab8a6a

Roblee Capital is a Torontobased M&A Investment Bank focused on serving companies with revenues between $1MM to $100MM primarily offering sell and buyside M&A services. We work with Canadianbased business owners looking to sell their lower midmarket business. If you are a Canadian business owner looking to sell or buy, please reach out so we can connect at the link below:

https://www.robleecapital.ca/