Vanguard Personal Investor Australia Review (Updated for 2021 Fee Changes)

Vanguard Australia recently updated the fee structure for their Vanguard Personal Investor offering in Australia in August 2021. Find out whether it’s worth using vs Vanguard ETFs in Australia on the ASX or Vanguard Retail or Vanguard Wholesale Managed Funds through Vanguard Australia directly.

Low Fee Stock Brokerages (My Referral Links):

SelfWealth AUS Shares (5 FREE TRADES): https://secure.selfwealth.com.au/Regi...

Stake US Shares (1 FREE STOCK): https://hellostake.com/referralprogr...

Pearler (1 FREE TRADE): https://pearler.com/home?deal=michaelko

Best Book For Passive Investing: https://amzn.to/3fBs7At

My Camera and Recording Setup: https://amzn.to/2DJYeR2

Join The Passive Investing Australia Facebook Group: / passiveinvesting

Follow Me On Socials:

Twitter: / okleahcim

Instagram: / michaelko

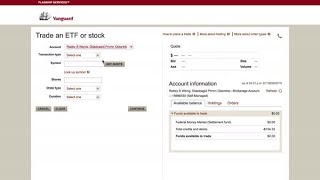

Vanguard Australia recently announced that they are updating their fee structure on their Vanguard Personal Investor Australia Product – and to cut to the chase, they’ve made some pretty significant changes. I wasn’t super impressed with the product when it launched in 2020, which I covered in my original Vanguard Personal Investor review. But with these product changes that are going live on the 18th August 2021 (or already live depending on when you are watching this), I wanted to do an updated review to cover what’s changed and whether its worth using or not.

So in the post, in addition to going over the recent changes – I’ll do a detailed review of the Vanguard Personal Investor offering in Australia, and how it stacks up compared to purchasing Vanguard ETFs through another stock broker, and also how it compares to investing directly into Vanguard Retail or Wholesale Funds. This way you will know in exactly which situations it will be optimal for you to be using Vanguard Personal Investor in Australia, as it is not that straightforward.

Summary of Vanguard

For those of you who don’t know who or what Vanguard is, I’ll keep this brief but Vanguard is a fund manager and is actually the largest provider of mutual funds in the world. And in Australia, they are by far the most popular fund manager and ETF manager in the country. They’ve got 82 funds with over $164B of assets under management, they also won a bunch of awards related to investing and managed funds.

Research links and text version here: https://www.walletlab.com.au/vanguard...

![Vanguard Australian Shares Index ETF (ASX:VAS) ETF Review [2022 & 2023]](https://i.ytimg.com/vi/bvaw80VjiWk/mqdefault.jpg)