Ride Massive Trends With This Moving Average Strategy

Identifying a trend in the market and using moving averages for trend following strategy, along with back testing and adjusting trading rules, is essential for profitable trading. Join Andrew in this video as we explore this simple trend following strategy using moving average.

00:00 Establishing a Strong Foundation

Discover the importance of identifying market trends through topdown analysis.

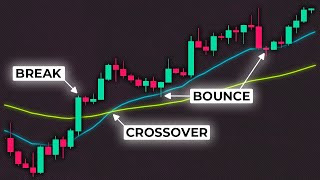

Learn a sound trendfollowing strategy using three exponential moving averages (10, 20, and 40).

Explore the crucial role of backtesting and adjusting trading rules for a personalized approach.

02:04 Perfecting Entry and Analysis

Utilize fast, medium, and slow moving averages for a comprehensive trendfollowing strategy.

Identify support and resistance levels on the daily chart to make informed trading decisions.

Harness the power of the 4hour chart for trade direction and entry analysis.

04:49 Precision in Trading

Use moving averages to determine trend direction and find opportunities within established trends.

Execute sell trades strategically during pullbacks, guided by the 10 and 20 moving averages.

Make decisions based on closing prices, set stop and position sizes, and exit strategically.

06:32 Maximize Profits, Minimize Risks

Learn the art of placing trades based on closing prices.

Set effective stop and position sizes to manage risks.

Explore the concept of exiting trades in tranches to optimize profitability.

07:36 Backtesting and Timeframe Considerations

Let's discuss the psychology of trading and its impact on strategy effectiveness.

Backtest the trendfollowing strategy with substantial data for robust results.

Align higher time frame trends with lower time frame entries, emphasizing the confirmation from the 10, 20, and 40 moving averages.

09:33 FineTuning Entry and Exit Strategies

Enter trades in the direction of the trend, backed by initial stop and exit rules.

Utilize lagging indicators to stay in trades for extended periods.

Explore the option of a takeprofit target with a fourfold risk factor for capitalizing on strong trends.

12:12 Commit to Consistent Profitability

Emphasize the importance of backtesting and adhering to the trendfollowing strategy with defined rules.

13:30 Join the City Traders Community

Discover City Traders, a prop firm and funding company offering education and funding opportunities.

#TradingStrategies #MovingAverages #ProfitableTrading #TheCityTradersCommunity

Join our Free Discord Community: bit.ly/TCTDiscord

Apply for Funding: https://www.thecitytraders.com

FREE Weekly Watchlist and Market Report: https://go.thecitytraders.com/weekly...

Download FREE Naked Trading Cheatsheet: https://go.thecitytraders.com/nakedt...

Download FREE Boomerang Trend & Reverse Strategy Cheatsheet: https://go.thecitytraders.com/1234tr...

Connect with us on Social Media

Facebook: / thecitytraderscom

Instagram: / thecitytraderscom

Twitter: / citytraderscom

Tiktok: / thecitytraderscom

LinkedIn: / thecitytradescom

About The City Traders

The City Traders is a community of aspiring traders who can explore effective methodologies to eventually make a career as a funded trader. We know that the education and proprietary trading industry is crowded with unrealistic expectations and criteria resulting in failures.

We are solving these problems by focusing on three crucial areas:

Comprehensive education from real traders

Funding program designed by traders for traders

Growth in performance and personal development

We strive to enable every community member to own their future and equip them with the skills and support they need throughout varying economic conditions.

Risk Disclaimer

Trading the financial markets carries a high level of risk, and may not be suitable for everyone. The information made available here is to provide education only and not investment advice. We recommend that you seek professional advice before carrying out specific transactions and investments.

Futures, CFD, Margined Foreign Exchange trading, Warrants, Options, and Spread Betting carry a high level of risk to your capital. A key risk of leveraged trading is that if a position moves against you, the customer, you can incur additional liabilities far over your initial margin deposit. Only speculate with money you can afford to lose. Futures, CFD, Margined Foreign Exchange trading and Spread/Binary Betting may not be suitable for all customers, therefore ensure you fully understand the risks involved.