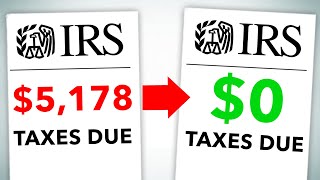

MILLIONS Put On IRS Radar Due to NEW $600 1099K Threshold 🔴 (1099K 2022 Explained)

(IRS $600 Reporting) Please see the detailed 1099K examples in the video to gain a greater understanding

Complete tax video playlist: • Income Taxes Explained

Chapters (Time Stamps):

0:30 Will the 1099K affect you?

1:10 1099K will impact nonbusiness owners as well

1:42 2022 1099K rules

2:50 How the 1099K works

3:34 Why the IRS is changing the 1099K rules

4:52 Detailed Examples 1 & 2

6:20 Business deductions to offset 1099K income

7:25 1099K and personal (Nonbusiness sales) and explanation

https://www.irs.gov/businesses/unders...

Form 1099K, Payment Card and ThirdParty Network Transactions, is an IRS information return used to report certain payment transactions to improve voluntary tax compliance. You should receive Form 1099K by January 31st if, in the prior calendar year, you received payments:

From payment card transactions (e.g., debit, credit, or storedvalue cards), and/or

In settlement of thirdparty payment network transactions above the minimum reporting thresholds as follows:

For returns for calendar years prior to 2022:

Gross payments that exceed $20,000, AND

More than 200 such transactions

For returns for calendar years after 2021:

Gross payments that exceed $600, AND

Any number of transactions

NOTE: The minimum reporting thresholds apply only to payments settled through a thirdparty network; there is no threshold for payment card transactions.

It is important that your business books and records reflect your business income, including any amounts that may be reported on Form 1099K. You must report on your income tax return all income you receive from your business. In most cases, your business income will be in the form of cash, checks, and debit/credit card payments. Business income is generally referred to as gross receipts on income tax returns. Therefore, you should consider the amounts shown on Form 1099K, along with all other amounts received, when calculating gross receipts for your income tax return.

Check your payment card receipt records and merchant statements to confirm that the amount on your Form 1099K is accurate

Review your records to ensure your gross receipts are accurate and reported correctly on your income tax return

Determine whether you have reported income from all forms of payment received, including cash, checks, and debit, credit, and storedvalue card transactions

Maintain documentation to support both the income and deductions you report on your income tax return

Checkout some of our most popular INVESTING and TAX related videos

✅ Earn $100,000 a year in dividends: • Earn $100,000 Per Year in Dividend In...

✅ Dividend Investing Pros and Cons: • Dividend Investing: Pros and Cons of ...

✅ Our Dividend Income Year 6: • Our Dividend Income Growth Journey ...

✅ Best Investments for each account • Best Investments For Each Type of Acc...

✅ Calculating dividend tax rates: • Your Dividend Tax Rates! 3 EXAMPLES! ...

✅ Making your dividends qualified!: • Qualified Dividends Fully Explained (...

✅ How to save taxes on stocks: • How To Save Taxes On Stocks 5 Tax S...

✅ Capital Gain Taxes Explained: • Capital Gains Tax Explained How Stoc...

✅ New Tax Laws for 2020 Explained: • New Tax Laws for 2020 Explained! (202...

✅ Dividend and REIT Taxation: • Dividend and REIT Taxation Explained ...

✅ How to fill out the new 2020 W4 • How to Fill Out the New 2020 W4 Form...

![14 Biggest Tax Write Offs for Small Businesses! [What the Top 1% WriteOff]](https://i.ytimg.com/vi/5YggWhLeckM/mqdefault.jpg)