IRS Form 8824 walkthrough (Like-Kind Exchanges)

Subscribe to our YouTube channel: / @teachmepersonalfinance2169

Please feel free to check out our article, where we've written step by step instructions to help you walk through this tax form! https://www.teachmepersonalfinance.co...

If you’re looking for tutorials for other IRS Forms that you can file directly through the IRS website, check out our free fillable forms page: https://www.teachmepersonalfinance.co...

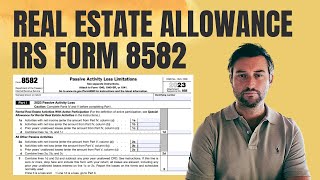

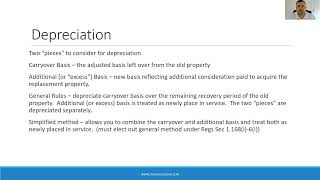

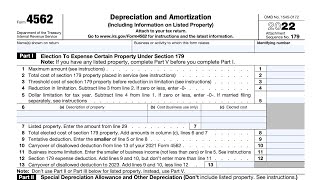

Use Parts I, II, and III of Form 8824 to report each exchange of business or investment real property for real property of a like kind. Form 8824 figures the amount of gain deferred as a result of a likekind exchange. Use Part III to figure the amount of gain required to be reported on the tax return in the current year if cash or property that isn't of a like kind is involved in the exchange. Also, use Part III to figure the basis of the likekind property received.

Certain members of the executive branch of the federal government and judicial officers of the federal government use Part IV to elect to defer gain on conflictofinterest sales. Judicial officers of the federal government are the following.

Chief Justice of the United States.

Associate Justices of the Supreme Court.

Judges of the:

United States courts of appeals;

United States district courts, including the district courts in Guam, the Northern Mariana Islands, and the Virgin Islands;

Court of Appeals for the Federal Circuit;

Court of International Trade;

Tax Court;

Court of Federal Claims;

Court of Appeals for Veterans Claims;

United States Court of Appeals for the Armed Forces; and

Any court created by an Act of Congress, the judges of which are entitled to hold office during good behavior.

![How to Calculate Taxable Gain from Selling a Rental [Tax Smart Daily 020]](https://i.ytimg.com/vi/VFqIr0GQKSk/mqdefault.jpg)