How to settle a debt collection lawsuit (In 3 parts!)

Go here to win your lawsuit by settling: https://bit.ly/3W855pY

Go here to respond to your debt lawsuit: https://bit.ly/3KUKwbw

Ask questions here for a fast response: https://help.solosuit.com/support/dis...

HOW TO SETTLE A DEBT COLLECTION LAWSUIT

Strategy

Tactics

Aftermath

Strategy

Settlement is usually the best option if you owe any part of the debt. File an Answer, then settle.

About one in 13 consumers with a credit record has made a debt settlement agreement on one or more of their accounts

File an Answer

Do nothing

Do something invalid

Try to settle too early

Bankruptcy?

Karina P

I got hit with a law suit and starting looking up information online. I found Solosuit and decided to try them out. At first I was just interested in their free services. But I ended up going with a higher option and made the purchase for their service. They literally printed and mail my documents that day. It was very easy to complete the forms and upload the documents. I was initially worried of course, didn’t know if it was a scam or if the courts would accept the documents. The courts accepted the documents and received them within 3 days. I definitely recommend them! Great & fast service. Definitely legit! Thanks again!

karrinaperezreview.png

[BREAK]

Tactics

File an Answer

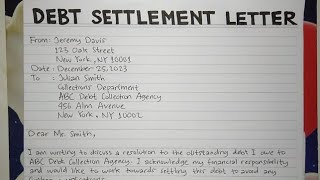

Within 30 days, send a Debt Lawsuit Settlement Letter

Determine lump sum target amount

How much money do you have on hand now? How much can you have in a month?

Debt buyer, offer 1%–60%. Bought for 8%. If they settle for 10 percent of the debt, they will earn 2 percent.

Original creditor, offer 20%70%.

Lump sum allows you to settle for less. Payment plans, you’ll pay more.

Avoid payment plans

Ackerman approach

Set target price

first offer 65%

Use empathy nos (How am I supposed to accept that? It’s really embarrassing, but I can’t accept it)

Three raises: 85% 95% 100%

Use nonround numbers on final offer

Throw in nonmonetary

Insert clip from debtpayoff video of me negotiating down debt on the phone. Clip can be pretty short (less than a minute).

When they accept, create a settlement agreement.

The dollar amount

“Settlement in full”

Case number

They will file dismissal with prejudice.

Date

Send payment, check is probably easiest.

Cashier’s check or money order

Followup to ensure they file for dismissal.

[BREAK]

Aftermath

How will it affect my Credit report?

You’re credit score will go down.

The impact will be worse on higher scores.

Credit scores are dinged because you aren’t paying back the money in accord with the original agreement.

35% of FICO’s credit score relates to payment history. 30% to amount owed.

If the lender agrees, your debt is reported to the credit bureaus as “paidsettled”

This is better than a chargeoff.

But it doesn’t mean the same thing as “paid as agreed”

Try to negotiate to have it reported as “paid in full”

A Debt settlement stays on your credit report for 7 years

Current accounts have the biggest impact on your credit score. So don’t risk missing payments on current accounts to settle an old one.

Most people get 60%30% hacked off of the debt, according to the AFCC

Settling has less of an impact if the account is delinquent.

[BREAK]

Taxes

10% to 37% for 2022

Taxes are progressive, you’ll be taxed more as your income increases.

The difference between the settlement amount and the total amount will be considered taxable income. The difference is called “cancelled debt.”

Generally you must include the debt in your income. Exceptions and exclusions apply.

Student loans are a common exception

Exclusions: bankruptcy, insolvency (the amount of debt you owe is greater than all of your assets.

The collector may send a 1099C to you and give notice to the IRS.

[STOP]