How to Pay IRS Tax Online

How to pay IRS tax online

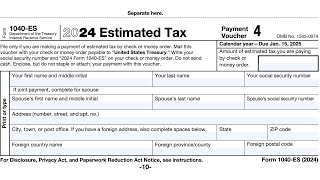

There are 2 ways to go about making a payment online to the IRS for your taxes. You can either make the payment via a direct debit with your checking or saving account or you can pay with a credit card.

Since there are fees to use a card I will only be going over the direct debit option using your checking or savings account.

All IRS Tax Payment options: https://www.irs.gov/payments

3 ways to pay IRS Tax without fees:

1. IRS Direct Pay https://directpay.irs.gov/directpay/p...

2. IRS account https://www.irs.gov/payments/youronl...

3. EFTPS https://www.eftps.gov/eftps/

Pay IRS Tax with debit or Credit Card https://www.irs.gov/payments/payyour...

00:00 Intro

00:53 Different ways to pay IRS Tax online

02:05 Pay IRS Tax without any fees

03:45 Common Errors when paying IRS Online

EA Tax Resolutions Website: https://eataxresolutions.com/?utm_sou...

Why Most IRS Offer in Compromise Get Rejected: • Why Most IRS Offer in Compromise Get ...

IRS Form 433A (OIC) Offer in Compromise Example numbers used that got accepted by IRS. • IRS Form 433A (OIC) Offer in Comprom...

Case Study IRS Offer in Compromise Accepted: • IRS Offer in Compromise Case Study...

///

Disclaimer: The information provided in this video is for informational purposes only and is not meant to take the place of professional legal, accounting, or financial advice. If you have any legal questions about this video or the subjects discussed, or any other legal matter, you should consult with an attorney or tax professional in your jurisdiction (i.e. where you live).

#IRS #HowToPayTaxOnline #Tax