How To Do Your Crypto Taxes With TurboTax (2023 Edition) | CoinLedger

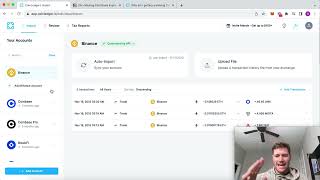

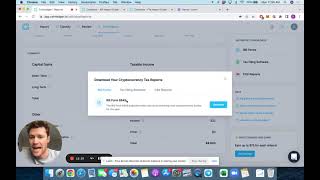

In this video, we demonstrate the stepbystep process to report your bitcoin and cryptocurrency gains and losses on TurboTax in tandem with CoinLedger.

How to enter crypto gains and losses into TurboTax:

1. Navigate to TurboTax Online and select the Premier or SelfEmployment package

2. Answer initial prompts and questions

3. Select ‘I Sold Stock, Crypto, or Other Investments’.

4. Navigate to the Cryptocurrency Section

5. Add your cryptocurrency data

6. Select 'Yes' to having investment income in 2022

7. Select "Enter a different way" on tax import screen

8. Select cryptocurrency for the investment type

9. Select "Upload it from my computer"

10. Select "Other (Gain/Loss)" as your platform

11. Import the 'TurboTax Online' CSV file you received from CoinLedger

12. Review your sales and hit 'Continue'

Full article explaining this with images: https://coinledger.io/blog/howtofil...

Timestamps:

0:00 Introduction

0:18 Navigate to Wages & Income Section of TurboTax

0:50 Answer crypto related prompts

1:26 Select 'Enter a Different Way'

1:46 Select 'Other (Gain/Loss)' as CSV source

2:04 Import your CoinLedger TurboTax Online CSV File

#cryptocurrency #TurboTax #bitcoin