How to Calculate Basis for S Corporation Stock

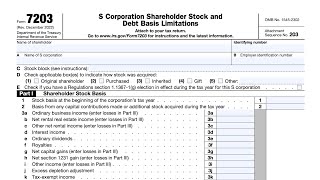

A shareholder's basis in S corporation stock is calculated by making a series of upward and downward adjustments to the shareholder's initial stock basis.

You can calculate a shareholder's basis in S corporation stock as follows:

initial basis

+ capital contributions

+ ordinary income (pro rata share)

+ separately stated income (pro rata share)

+ taxexempt income (pro rata share)

+ nonoil and nongas depletion in excess of the property's basis (pro rata share)

distributions not reported as income

nondeductible, noncapital expenses such as fines and penalties (pro rata share)

ordinary loss (pro rata share)

separately stated loss and deductions (pro rata share)

oil and gas depletion that doesn't exceed the property's basis (pro rata share)

= new basis

Adjustments are made in a certain order. Here are the ordering rules:

(1) basis is first increased by the pro rata share of income items and excess depletion

(2) basis is next decreased by distributions

(3) basis is then decreased by nondeductible, noncapital expenses*

(4) basis is finally decreased by deductions and losses

*A shareholder can elect to have losses reduce their stock basis before accounting for nondeductible, noncapital expenses.

Note that a shareholder's basis in S corporation stock can never go below zero (a negative basis isn't possible).

—

Edspira is the creation of Michael McLaughlin, an awardwinning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a highquality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44PAGE GUIDE TO U.S. TAXATION

• A 75PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSETLIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast...

* Spotify: https://open.spotify.com/show/4WaNTqV...

* Website: https://www.edspira.com/podcast2/

—

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

—

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / profmichaelmclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com