How Do You

Do I Qualify for Chapter 7 Bankruptcy?

Chapter 7 bankruptcy provides relief from your debt by wiping out most unsecured debt and allowing you to have a fresh start. The catch of course is that you have to qualify for Chapter 7.

Congress has provided eligibility requirements for filing a Chapter 7 case. Here are the main requirements to qualify for Chapter 7 bankruptcy relief.

Prior Bankruptcies

If you filed a Chapter 7 petition and received a discharge in the past, you must wait eight years from the filing date of the previous bankruptcy before filing another one.

If you previously filed and received a discharge in a Chapter 13 bankruptcy case, you must wait six years from the date that Chapter 13 was filed before filing for Chapter 7. If you did not complete or receive a discharge in the previous Chapter 13 case, you can file a Chapter 7 case at any time assuming you otherwise qualified for Chapter 7.

#Prefiling Bankruptcy #Credit Counseling

Before you file for Chapter 7 bankruptcy, you must complete a prefiling bankruptcy credit counseling course conducted by an approved credit counseling agency.

You can find an approved providers for your state at this link: https://www.justice.gov/ust

You must complete this course within six months prior to the date you file for bankruptcy. Once the counseling is complete, you will receive a certificate that you must file with the court.

The #Means #Test

With the enactment of the Bankruptcy Abuse and Consumer Protection Act of 2005 ("BAPCA"), bankruptcy debtors are now required to pass a "means test" in order to qualify for Chapter 7 bankruptcy.

Passing the Means Test

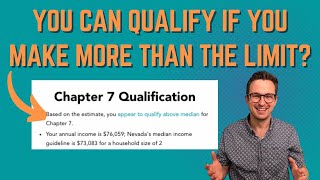

In order to pass the means test, you must have little or no disposable income. To determine whether you qualify for Chapter 7 bankruptcy, the means test compares your average monthly income for the sixmonth period preceding your bankruptcy against the median income of a similar household in your state. If your income is below the median, you automatically qualify.

While the median income figures vary from state to state, in most cases, people who are having financial difficulties are making little or no income so the means test does not pose a problem.

What Are Your Options If Your Income Is Above the Median?

What happens if your income is above your state's median? Does it mean you cannot file Chapter 7? Not necessarily!

If your income is above median, you must complete the entire means test form instead of qualifying simply based on your income. The means test is essentially a balancing stage where your expenses are weighed against your income. For many expenses, the means test only allows you to deduct the national or local standard living allowance.

If deducting all allowable expenses from your income results in little or no disposable income, you can file for Chapter 7 bankruptcy.

Here are some common questions we hear about filing bankruptcy:

⭐https://georgiabankruptcylawgroup.com...

Review some our recent case results

⭐https://georgiabankruptcylawgroup.com...

For more information about Chapter 13 and Chapter 7 bankruptcy:

https://georgiabankruptcylawgroup.com...

QUESTIONS ABOUT BANKRUPTCY? Check out the links below

SCHEDULE A FREE PHONE/VIDEO CONFIDENTIAL CONSULTATION WITH A GEORGIA BANKRUPTCY LAWYER:

https://georgiabankruptcylawgroup.com...

FREE GUIDE TO DEALING WITH DEBT IN GEORGIA:

https://georgiabankruptcylawgroup.com...

FREE GUIDE TO FORECLOSURE IN GEORGIA:

https://georgiabankruptcylawgroup.com...

TOP GEORGIA BANKRUPTCY LAWYERS

Saedi Law Group are experienced Atlanta #bankruptcy #lawyers who have been helping Georgians file for bankruptcy for over 20 years.

➡We have filed thousands of bankruptcy cases here in Georgia and are in court every day fighting for our client's rights against creditors.

If you are currently struggling with overwhelming debt, or feel your financial situation will be severely stressed in the coming weeks, now is the best time to start looking at all options available to you.

Saedi Law Group offers a free, no obligation consultation with an experienced attorney (not a paralegal) who will review your specific situation and advise you about your options for moving forward.

Our team is passionate about our work and we take it very seriously. It is a privilege to help clients and their families in times like these.

➡Contact us today at (404) 9197296 to learn about what you can do to protect your future.

#bankruptcy #lawyer #attorney #foreclosure #debt #meanstest #howto #repossession #lawsuit #creditcarddebt #freshstart #Atlantabankruptcyattorney #Atlantabankruptcylawyer