Gold Trading: What is the Best Indicator?

Trade with zero comissions, no transaction fees and a marketleading spread on gold: https://bit.ly/39UMQfB

Read more about trading Gold: https://bit.ly/3QFiYKN

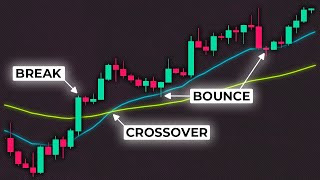

How to trade Gold? A question on many traders’ and investors’ minds. Many follow the news, others pour over data to find fundamental reasons for the way the Gold chart looks and others delve into Gold technical analysis. In this video we focus on three indicators that many traders use in technical analysis the RSI, MACD and Moving Averages.

We’ll show you how to use them in actual gold trading scenarios, what they mean and how to interpret them to aid your own Gold trading strategy. We focus on the overbought/oversold levels of the RSI, as well as the moving average lines on the chart, that cross over and under the candlesticks, all on the actual Gold chart.

One thng that you do have to remember, especially if you’re at the “Gold trading for beginners” phase indicators aren’t always right. There are a multitude of factors at play at any given time and with Gold being one of the most popular markets in the world, it’s susceptible to many market forces, that can’t always be explained with technical indicators.

But at the same time, these Gold indicators are the closest thing traders and investors have to a tool that provides a reliable measurement.

Do you have another answer to the question “What is the best chart indicator?” let us know in the comments!

Give us a thumbs up if you liked this video about what is the best chart indicator for Gold and remember to subscribe to the capital.com channel for more videos about Gold in 2019!

#Gold

#Trading

#Indicators

***

Explore trading and start investing with Capital.com.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

![BEST TradingView Indicator for SCALPING gets 96.8% WIN RATE [SCALPING TRADING STRATEGY]](https://i.ytimg.com/vi/2U5VTWBBK8U/mqdefault.jpg)