Fixed Income Fundamentals

Introduction to Fixed Income Course Preview | Corporate Finance Institute

Enroll in the FULL course to earn your certificate and advance your career: https://courses.corporatefinanceinsti...

This 2part series will introduce you to the main products and players in the fixed income markets. It illustrates the points covered using real market data and examples of the most commonly used Bloomberg screens for bonds. Core concepts such as bond pricing, duration and yield curves are covered in detail. This course incorporates a wide range of applied exercises and case studies together with quizzes to test what you are learnt.

Module 1

In this first module we explore the key features of a bond including the issuer, coupon and maturity date. The key issuers are covered and ratings for bonds are discussed. Bond prices are driven by changes in the yield curve. Typical yield curve shapes are investigated together with how the yield curve moves through the economic cycle. The module uses Bloomberg’s DES, YAS and IYC screens to illustrate the points discussed.

1 Learn the key features of fixed income securities & bonds

2 Understand the yield curve and what it represents

3 Track yield curve changes throughout the economic cycle

Module 2

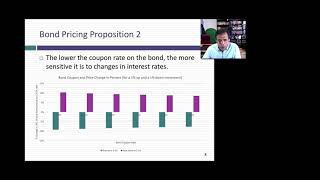

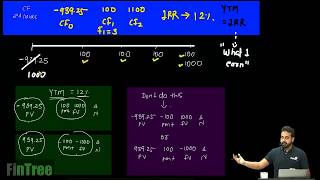

The second module starts by demonstrating how bonds are priced using discounted cash flow and the relationship between a bond’s price and its yield. Clean prices, dirty prices and accrued interest are also discussed. Understanding how bond prices move as their yields moved is a fundamental concept in the fixed income market. Macaulay and modified duration are both explained. The session provides an intuitive explanation of these concepts before looking at the detailed calculations.

1 Use DCF to price bonds

2 Learn the relationship between bond prices and yields

3 Use duration to learn how bond prices move in the market

This course incorporates a wide range of applied exercises and case studies. Sophisticated search and navigation tools allow you to go at your own pace while pop quizzes test what you’ve just learnt. The course also includes two PDF reference guides – an accounting factsheet and a financial statements glossary that can be used while taking the course and downloaded to your computer for future reference.

FREE COURSES & CERTIFICATES

Enroll in our FREE online courses and earn industryrecognized certificates to advance your career:

► Introduction to Corporate Finance: https://loom.ly/us5oJEw

► Excel Fundamentals: https://loom.ly/4KnYciU

► Accounting Fundamentals: https://loom.ly/xHJgJO4

► Reading Financial Statements: https://loom.ly/2wrcPw8

► Fixed Income Fundamentals: https://loom.ly/DZdjDA0

ABOUT CORPORATE FINANCE INSTITUTE

CFI is a leading global provider of online financial modeling and valuation courses for financial analysts. Our programs and certifications have been delivered to thousands of individuals at the top universities, investment banks, accounting firms and operating companies in the world.

By taking our courses you can expect to learn industryleading best practices from professional Wall Street trainers. Our courses are extremely practical with stepbystep instructions to help you become a first class financial analyst.

Explore CFI courses: https://courses.corporatefinanceinsti...

JOIN US ON SOCIAL MEDIA

LinkedIn: / corporatefinanceinstitutecfi

Facebook: / corporatefinanceinstitute.cfi

Instagram: / corporatefinanceinstitute