Farm Tax Exemption- Expert Advice!

It's tax time! If you run a farm business, you know that it pays to save money wherever you can. Why not just keep your money through deductible farm expenses?

Many people who sell an agricultural or horticultural commodity, like poultry farmers, are eligible for tax breaks based off of their business expenses. This week, we sit down with our friend and tax professional Chad Brown, who gives us all of his best tips on how folks with a farm business can maximize their tax benefit.

Learn more on our blog here: https://www.southlandorganics.com/blo...

Getting your taxes paid for your farming operation can be daunting. I mean, who really likes to pay taxes anyway? Some famers try to rush through their taxes and get them out of the way, potentially reducing the amount of tax exemptions they could receive for their business operations.

Even though rushing through the tax process might seem easier, it truly pays back to be meticulous about maximizing your tax benefits.

Chad has good news! it's actually a great time to be a farmer from a tax standpoint in the current year.

Recent legislative decisions have not passed any bills that harm farmers from a tax perspective. No opportunities for deductions have changed, and folks with farms get the same benefits of depreciation (up to one million dollars) in equipment.

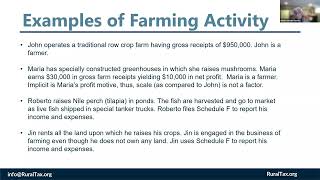

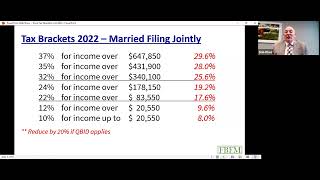

One of the most important deductions to look into is called QBI. This is a deduction for businesses where you can deduct 20% of your profit from your taxable income. Then, you just pay taxes on the 80% that's left over. Most farms qualify for QBI, so make sure to take advantage of this option!

If you make a business use of your home, you may qualify for a home office deduction. The only catch is that you have to have no other location where officerelated tasks can be done. This is likely true for a lot of farms think about where you conduct your officerelated business. If it's in your home, be sure to look into the home office deduction!

Some farms look like they're losing money on paper. If this is the case for your farm, you can use your losses to offset your spouse's W2. Your losses can be accounted for and then subtracted from the amount of income tax your spouse pays. This same rule can apply if you own another business outside of your farm. This can add up to a refund of several grand that you get to keep in your family!

Due to new dependency laws, if you have kids under 17 there's much more to take advantage of. Child tax credit had almost doubled. So if you have kids who aren't adults yet, look into this too.

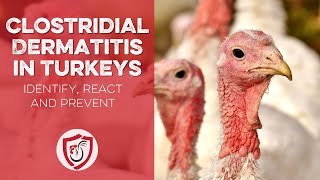

If you raise livestock, you qualify for so many tax loopholes and qualifying items for deductions. There are tons of deductions for folks with a farm, so hiring a tax pro is absolutely the best way to keep track and take advantage of all of these.

To truly maximize your tax deductions, you need to keep really close track of all your expenses. Even just small, $10 purchases can add up to thousands. If you're not keeping up with this, you could miss out on plenty of money. The easiest way to keep track of all of this is to get a professional to help you keep track of all the deductions.

Certain expenses you may not even think of as deductible could slip by if you're not paying close attention! Boots, equipment, machines... you need every deduction to keep as much money as possible from your farm. Your farm income is your lifeblood. You deserve to keep it!

Depending on where you live, you can qualify for a sales tax exemption on agricultural equipment and production inputs. Check to see if this is available in your state so you can get an exemption number and certificate to show you are eligible for sales tax exemption.

If you live in Georgia, you can use the Georgia Agriculture Tax Exemption (GATE) program to receive this benefit.

A few more things to look into include if you qualify for self employment tax reductions, whether or not you're a cash basis taxpayer and if you have any prepaid expenses to consider. The best way to holistically consider all of these elements is to hire a tax pro who is familiar with small business taxes.

We've said it before and we'll say it again we always recommend you seek advice from a tax professional.

They can offer taxpayer services that save you way more money than you'll get back from your taxes. This advice is essential, potentially reducing the amount of money from your farm income that you have to hand over.

For those who produce agricultural products, it's essential to hire someone who knows what they're doing and has farm or business experience. Even a small farm can save thousands each year

No tax professional costs more than the amount you'll save by utilizing their expertise. You'll save way more than you're charged! We say pay a little to make a lot.

It's better off you spend your energy growing birds make that money and then hire someone to help you save it.