Credit Derivatives u0026 Credit Default Swaps - CFA Level 2 / CA Final AFM (New Syllabus)

This video is also applicable for CA Final Advanced Financial Management (May24 Amendments)

This video is in English.

About Credit Derivatives:

Credit Derivatives is summation of two terms, Credit + Derivatives.

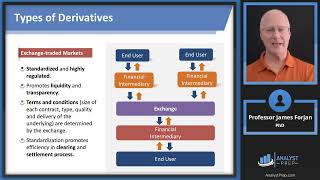

As we know that derivative implies value deriving from an underlying, and this underlying can be anything we discussed earlier i.e. stock, share, currency, interest etc.

A credit derivative is a contract whose value depends on the creditworthiness or a credit event experienced by the entity referenced in the contract.

A credit derivative allows creditors to transfer to a third party the potential risk of the debtor defaulting, in exchange for paying a fee, known as the premium.

The financial products are subject to following two types of risks:

a) Market Risk: Due to adverse movement of the stock market, interest rates and foreign exchange rates.

b) Credit Risk: Also called counter party or default risk, this risk involves nonfulfilment of obligation by the counter party.

While, financial derivatives can be used to hedge the market risk, credit derivatives emerged out to mitigate the credit risk.

Accordingly, the credit derivative is a mechanism whereby the risk is transferred from the risk averse investor to those who wish to assume the risk.

The primary purpose of credit derivatives is to enable the efficient transfer and repackaging of credit risk. Our definition of credit risk encompasses all creditrelated events ranging from a spread widening, through a ratings downgrade, all the way to default.

A bank can use a credit derivative to transfer some or all of the credit risk of a loan to another party or to take additional risks. In principle, credit derivatives are tools that enable banks to manage their portfolio of credit risks more efficiently.

About Credit Default Swaps:

• Credit Default Swap (CDS) is a credit derivative that offers protection to the buyer against potential default and helps manage & transfer credit risk.

• Essentially, it is a contract between two parties, often referred to as the buyer and the seller, where the buyer pays a premium to the seller in exchange for protection against the default of a specific credit instrument, such as a bond or a loan.

• This financial tool has gained prominence for its ability to mitigate credit risk and its diverse applications across various sectors of the economy.

Through a credit swap, a buyer can take risk control measures by shifting the risk to an insurance company in exchange for periodic payments. Just like an insurance policy, a CDS allows purchasers to buy protection against an unlikely event that may affect the investment.

Credit default swaps (CDS) are a type of insurance against default risk by a particular company.

The company is called the reference entity and the default is called credit event.

It is a contract between two parties, called protection buyer and protection seller.

Under the contract, the protection buyer is compensated for any loss emanating from a credit event in a reference instrument.

In return, the protection buyer makes periodic payments to the protection seller.

In the event of a default, the buyer receives the face value of the bond or loan from the protection seller. From the seller’s perspective, CDS provides a source of easy money if there is no credit event.

For further details on courses, contact us on 74004 48022 or visit our website https://sfmguru.com/

Please Join our Telegram Channel:

https://t.me/njsirsfmguru

We simplify your financial learnings. ►►Subscribe here to learn more of Advanced Strategic Financial Management: https://goo.gl/HTY5SN

Find us on Facebook: / sfmguru1862953747049133

Read more on our website: https://sfmguru.com/blog/

CA Final AFM Fast Track Course: https://sfmguru.com/product/cafinal...

►►About CA Nikhil Jobanputra:

CA NIKHIL JOBANPUTRA is a highly respected & accomplished professional educator with a demonstrated trajectory in the field of training CA and CMA students, known for his proficiency, dedication, and commitment in delivering top quality professional training and proven results. With over 20 years of experience, he has coached over 40,000 students across India. His expertise lies in teaching CA and CMA students, notably in Strategic Financial Management, Financial Reporting, IFRS & Ind AS.

He realized his penchant for teaching in 1997, when he started his Institute, post that there was no stopping him and the journey still continues as a Founder Faculty of Incito Academy. He is the founder and core faculty of SFM Guru, an institution that is known for making the learning experience interesting and engaging.

#cfalevel2 #creditderivatives #cafinalafm #cfa #cafinal