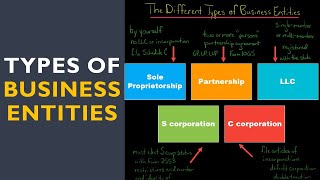

Comparing Business Entity Types

This video compares the following business entity types:

1. Sole proprietorship

2. Partnership

3. S corporation

4. C corporation

5. LLC

A sole proprietorship is easy to form and allows the owner to deduct losses of the business. However, the owner is personally liable for debts of the business and is subject to selfemployment tax on the business's income.

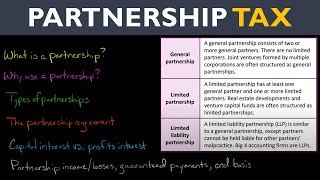

A partnership is also easy to form and allows the owners (partners) to deduct losses of the business. A partnership also allows partners to make special allocations of income and deductions, and a partnership is flexible in that virtually anyone (including a C corporation) can be a partner. However, guaranteed payments and the share of partnership income are subject to selfemployment tax, and partners are liable for the partnership's debts (unless they are a limited partner or it is an LLP).

An S corporation provides limited liability for its owners (shareholders) and is the best entity choice for reducing selfemployment tax. Shareholders may also deduct their pro rata share of the business's losses. There are multiple restrictions for S corporations, however. An S corporation can have a maximum of 100 shareholders, and no shareholders can be a C corporation, a partnership, or a nonresident alien. Moreover, an S corporation can only have one class of stock.

A C corporation also provides limited liability for its owners (shareholders), but can have an unlimited number of shareholders of any type. Shareholders, however, cannot deduct the losses of the business. Worst of all, a C corporation is subject to double taxation.

An LLC combines the limited liability of a corporation with the ability to be taxed as a partnership (or a sole proprietorship, if it is a singlemember LLC). However, LLCs have only been around since 1977 so the tax law surrounding certain types of transactions is not entirely clear.—

Edspira is the creation of Michael McLaughlin, an awardwinning professor who went from teenage homelessness to a PhD. Edspira’s mission is to make a highquality business education freely available to the world.

—

SUBSCRIBE FOR A FREE 53PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS:

• A 23PAGE GUIDE TO MANAGERIAL ACCOUNTING

• A 44PAGE GUIDE TO U.S. TAXATION

• A 75PAGE GUIDE TO FINANCIAL STATEMENT ANALYSIS

• MANY MORE FREE PDF GUIDES AND SPREADSHEETS

* http://eepurl.com/dIaa5z

—

SUPPORT EDSPIRA ON PATREON

* / prof_mclaughlin

—

GET CERTIFIED IN FINANCIAL STATEMENT ANALYSIS, IFRS 16, AND ASSETLIABILITY MANAGEMENT

* https://edspira.thinkific.com

—

LISTEN TO THE SCHEME PODCAST

* Apple Podcasts: https://podcasts.apple.com/us/podcast...

* Spotify: https://open.spotify.com/show/4WaNTqV...

* Website: https://www.edspira.com/podcast2/

—

GET TAX TIPS ON TIKTOK

* / prof_mclaughlin

—

ACCESS INDEX OF VIDEOS

* https://www.edspira.com/index

—

CONNECT WITH EDSPIRA

* Facebook: / edspira

* Instagram: / edspiradotcom

* LinkedIn: / edspira

—

CONNECT WITH MICHAEL

* Twitter: / prof_mclaughlin

* LinkedIn: / profmichaelmclaughlin

—

ABOUT EDSPIRA AND ITS CREATOR

* https://www.edspira.com/about/

* https://michaelmclaughlin.com

![How to File Taxes as an SCorp Owner [StepbyStep] | SCorp Tax Benefits](https://i.ytimg.com/vi/kM9k9ZDHj3o/mqdefault.jpg)