Collateralized Loan Obligations (CLOs) Explained in One Minute: Mortgage-Backed Securities 2.0?

Quite a few economists have expressed their concerns regarding socalled Collateralized Loan Obligations or CLOs, stating that we haven't learned enough after the MortgageBacked Security fiasco and that this time, we are making similar mistakes: not when it comes to mortgages but rather corporate debt.

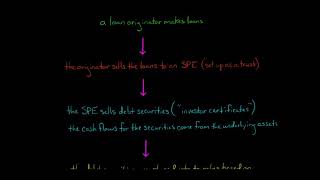

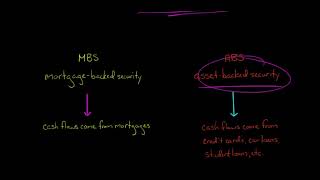

Simply put, Collateralized Loan Obligations are CDO types, just like MortgageBacked Securities, with the main difference being represented by the fact that another type of debt (corporate debt) is in the spotlight.

In the years that followed the Great Recession, the corporate sector had access to unprecedented levels of cheap as well as relatively easilyobtainable capital and as such, a lot of companies went overboard when it comes to taking on debt.

CLOs ended up therefore becoming more and more popular as time passed, with various tranches that investors can opt for based on their risk tolerance. Is there a Collateralized Loan Obligation bubble that is about to explode and if so, what should we know about these CLOs? Let's find out.