Chapter 7 Fraud Nondischargeability

Chapter 7 Fraud Nondischargeability http://www.goodbye2debt.com 5627779159

nondischargeable debts in chapter 7

11 usc 523(a)(7)

exempt property

define exempt property

which of the following items would you most likely be able to keep in chapter 7 bankruptcy?

assets exempt from seizure

list five types of exempt and five types of nonexempt property in bankruptcy

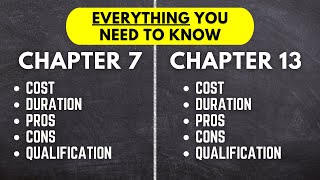

Chapter 7 is the mostly commonly filed bankruptcy chapter. Under Chapter 7 bankruptcy, many — in most cases, all — of your debts will be discharged. That means you will not have to repay them. Typically, unsecured debt, such as credit cards and medical bills, are discharged.

Most Chapter 7 debtors are able to exempt all of their assets, meaning that if your case is fairly typical, you may get to keep all of your possessions. As for an asset that serves as collateral for a secured debt — common examples include a house or a car — you can keep it if you are current and remain current on the payments, and can exempt the equity you have in the asset. However, if you want to keep property like a home or a car but are behind on the payments, a Chapter 7 case may not be the right choice for you.

Unfortunately, certain types of debt are not dischargeable under bankruptcy. A few examples include obligations to pay spousal support (alimony), child support, student loans, most taxes, and debts that result from your causing death or injury, either willfully and maliciously, or while under the influence of drugs or alcohol.

• Discharging Taxes in Bankruptcy

• Discharging taxes the two year rule a...

• Chapter 7 Nondischargeability

• Chapter 7 Fraud Nondischargeability

Chapter 7 Fraud Nondischargeability