CFA Level 2 | Fixed Income: Bootstrapping Spot Rates from Par Rates u0026 No-Arbitrage Valuation

Visit https://www.noesis.edu.sg for more info on CFA prep courses in Malaysia, Singapore, or wherever you are.

☕ Like the content? Support this channel by buying me a coffee at https://www.buymeacoffee.com/riskmaestro

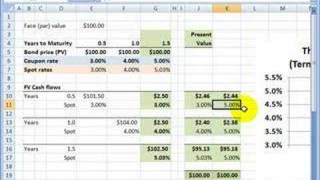

CFA Level 2

Topic: Fixed Income

Reading: The Term Structure and Interest Rate Dynamics

Par rates are the yield to maturities of government bonds that are newly issued (on the run), where the YTM is equals to the coupon rate (i.e. price is equals to par). Through the bootstrapping process, we can extract the spot rates from the par rates. The spot rates (or zerocoupon yields) can then be used to calculate the forward rates, or we can use it to calculate the noarbitrage value of a riskfree bond.

Visit www.noesis.edu.sg for more info on CFA prep courses in Malaysia, Singapore, Vietnam, or wherever you are.

Facebook: / noesismy

LinkedIn: / noesisklsg