Capital Budgeting (2021 Level II CFA® Exam – Reading 19)

Level II CFA® Program Video Lessons offered by AnalystPrep

For Level II Practice Cases and Mock Exams: https://analystprep.com/shop/practice...

For Level I Video Lessons, Study Notes, Question Bank, CBT Mock Exams & More: https://analystprep.com/shop/cfaleve...

For FRM (Part I & Part II) Video Lessons, Study Notes, Question Bank, CBT Mock Exams & More: https://analystprep.com/shop/unlimite...

Reading 19: Capital Budgeting

0:00 Introduction and Learning Outcome Statements

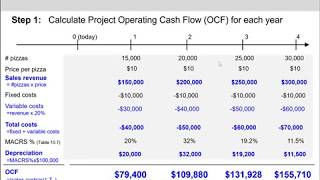

4:06 Calculate the yearly cash flows of expansion and replacement capital projects and evaluate how the choice of depreciation method affects those cash flows;

27:35 Explain how inflation affects capital budgeting analysis;

31:40 Evaluate capital projects and determine the optimal capital project in situations of mutually exclusive projects with unequal lives, using either the least common multiple of lives approach or the equivalent annual annuity approach, and capital rationing;

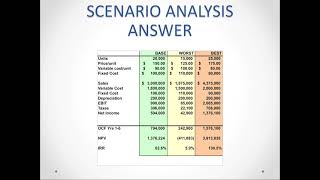

43:06 Explain how sensitivity analysis, scenario analysis, and Monte Carlo simulation can be used to assess the standalone risk of a capital project;

46:41 Explain and calculate the discount rate, based on market risk methods, to use in valuing a capital project;

52:44 Describe types of real options and evaluate a capital project using real options;

57:59 Describe common capital budgeting pitfalls;

1:01:21 Calculate and interpret accounting income and economic income in the context of capital budgeting;

1:04:25 Distinguish among the economic profit, residual income, and claims valuation.