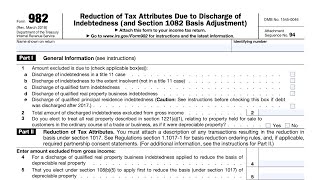

Cancelled Debt Income is Taxable! Use IRS Form 982 to Reduce Taxes on COD Income

For a 2023 update: • Form 1099C & Form 982 Cancelled De...

For a 2022 update: • IRS Form 1099C Explained with Form 9...

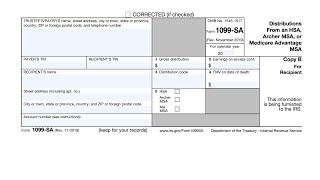

If you received Form 1099C during the year, that is taxable income!

Believe it or not, canceling debts is taxable income to a U.S. taxpayer, so it must be reported on your tax return. In certain cases, however, you might be able to exclude that income from your gross income.

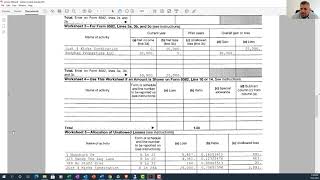

One of the easiest methods is to claim you are insolvent. Use Form 982 to claim insolvency.

For a larger database of tutorials, please visit our website and search for your question:

https://knottlearning.com/

DISCLAIMER: The information provided in this video may contain information about tax, financial, and legal topics. Such materials are for informational purposes only and may not reflect the most current developments. These informational materials are not intended and should not be taken as tax, financial, or legal advice. You should contact an advisor to discuss your specific facts and circumstances. Selfhelp services may not be permitted in all states or jurisdictions. The use of these materials does not create an attorneyclient or confidential relationship. This video does not include information about every topic or issue related to these informational materials.

#IRSform982 #Form982 #CancelledDebts

![How to Get IRS Back Taxes Forgiveness 3 Different Ways [IRS Back Taxes Help] #backtax](https://i.ytimg.com/vi/IMHfw1-ePZs/mqdefault.jpg)