BEFORE Trading Options Learn The Greeks | Options Trading For Beginners

Get Total Access To All My Financial Decisions, Option Plays & Private Discord Chat! / bradfinn

Webull Will Hook You Up With Up to 2 FREE STOCKS: https://act.webull.com/kolus/share.h...

The Beginners Guide To Trading Options: Use Code "OPTIONS" to get 50% off! https://averagemoney.teachable.com/p/...

1 FREE STOCK When You Sign Up For: Robinhood: https://robinhood.c3me6x.net/5R70o

♂♂ Curious About Bitcoin: Get $10 of it FOR FREE! https://www.coinbase.com/join/finn_jj

AVERAGE MONEY PODCAST: https://averagemoneypodcast.podbean.com

Average Money Free Discord Server! / discord

M1 Finance: https://m1finance.8bxp97.net/eLDV6

This FREE APP Tracks All My Financing And Investing in ONE PLACE. Personal Capital! https://share.personalcapital.com/x/y...

The Books I Recommend

The Gear I Use For The Channel And Podcast

Cool Things I Have Round The House

https://www.amazon.com/shop/bradfinn

CONNECT WITH ME:

Give Me A Call To Talk Money or YouTube: https://clarity.fm/bradfinn

Email: [email protected]

BEER MONEY DONATIONS

Venmo: https://venmo.com/TheFinnMindset

PAYPAL: https://paypal.me/bradfinn322?locale....

In this video we will break down The Greeks!

These Greeks include delta, gamma, vega, and theta and rho. These show a measure of the sensitivity of an option's value according to certain market conditions. The Greeks can seem intimidating if you are new to option trading, but I will break it down nice and easy.

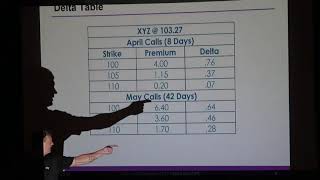

Delta measures how much an option's value is expected to change in a $1 change in the share price of the underlying stock.

Gamma measures the rate of change in an option’s Delta in a $1 change in the price of the underlying stocks share price.

Theta measures the change in the price of an options value for a oneday decrease in its time to expiration. This is time value and how much an options value will change after one day.

Vega measures the rate of change in an option’s value in a 1% change in the implied volatility of the underlying stock. FUN FACT.. Vega is not actually a Greek Letter.

Rho measures the expected change in an option’s value with a 1% point change in interest rates. It tells you how much the price of an option value should rise or fall if the riskfree interest rate (U.S. Treasurybills) increases or decreases.

Enjoy The Video

Cheers

DISCLAIMER: The content discussed in these videos are solely my opinion and should never be used as financial advice. This channel is for entertainment purposes only. Make sure to consult with a professional before making money decisions. This video and description contain affiliate links, which means that if you click on one of the product links, I’ll receive a small commission; all of which helps grow the channel! Thank you for your support!

![EVERYTHING You Need to Know to Profitably Trade Options | Options for Beginners [2024]](https://i.ytimg.com/vi/89NHBLDTQyk/mqdefault.jpg)